Planning for Investment Success

Planning for Investment Success

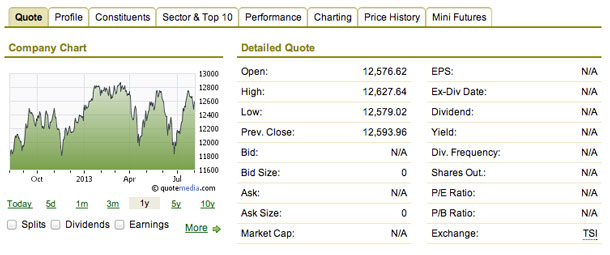

THUNDER BAY – Business – Investors who have stuck with one asset class as their investment of choice have almost always been disappointed by it at some point. Over the past several years, we’ve seen a push into gold as a must have for every portfolio as a safe haven against inflation and while it has performed well in the long run, it’s lost over a quarter of its value in 2013. This is just an example where diversification would help offset those losses.

In many cases, it is better to take the time to set a long-term mix of stocks, bonds, gold, and other investments according to your individual goals, time horizon and risk tolerance while making regular adjustments to your portfolio as necessary. Most investment success is realized by setting and maintaining a consistent asset allocation approach and sticking with it. No matter your age, or goals, having diversification will help you achieve the greatest success at the least amount of risk.

The goal of diversification isn’t to boost portfolio performance because it likely will not, but is too manage risk. Proper diversification allows for the right mix of portfolio correlation. Correlation is a measure of how two investments move together, in the same direction or in opposite directions. Historical calculations of portfolios with low correlation show that you may be able to achieve higher returns while taking on the same level of risk, or the same returns with lower risk.

The best way to achieve proper diversification for your individual needs is to know your target investment mix, to review your portfolio regularly, and rebalancing.

The Bottom Line

Portfolio diversification is just another step in having a successful long-term portfolio. It is important to talk to your financial advisor to discuss what is right for you and your plan. Should you have any other questions about portfolio diversification, do not hesitate to contact me by email or phone.

Anthony M. Talarico

Financial Security & Investment Representative

W: 807-343-4788 C: 807-472-6092