Canadians Warned of Rising Holiday Scams: TransUnion and CAFC Highlight Online Fraud Trends

Thunder Bay – Business – As the holiday season approaches, Canadians are being warned about an increase in online fraud and scams. A recent TransUnion® study indicated a 4.5% rise in suspected online fraud rates in Canada, with the Canadian Anti-Fraud Centre (CAFC) also outlining the most prevalent scams during the holidays.

A recent study by TransUnion® has revealed a 4.5% increase in suspected online fraud in Canada compared to the same period in 2022. The findings, particularly relevant during the holiday season, have raised concerns among Canadians regarding online security and personal data privacy.

Key Survey Findings: Increased Fraud and Consumer Anxiety

- A significant 80% of Canadians are apprehensive about falling victim to online fraud during the 2023 holiday season.

- Concerns about sharing personal information are high, with 70% of Canadians expressing worry.

- The most common fraud schemes reported were phishing (44%), smishing via text (37%), and vishing through phone calls (35%).

- Interestingly, over 1 in 5 Canadians (22%) are also concerned about government surveillance when sharing personal data.

Reported Target of Fraud and E-commerce Trends

- Nearly half (47%) of Canadians reported being targeted by fraud via online platforms, emails, phone calls, or text messages in the past three months, with 8% falling victim to these scams.

- Despite economic pressures, e-commerce transactions in Canada saw a 17.2% increase over the 2023 Cyber Five period (from Black Friday to Cyber Monday), compared to the five-year average from 2018-2022.

CAFC’s Top 12 Scams of the Holidays

- Counterfeit Merchandise: Beware of flashy discount ads leading to websites selling inferior or counterfeit products.

- Selling Goods & Services Online: Be cautious of overpayments and confirm legitimate payments before shipping products.

- Crypto Investments: Verify investment opportunities and the registration of the companies involved.

- Romance Scams: Avoid sending money to individuals met online.

- Online Shopping: Research before buying and prefer in-person exchanges or credit card payments.

- Cellphone and ISP Scam: Contact your service provider directly for any service changes.

- Secret Santa: Avoid social media gift exchanges that resemble pyramid schemes.

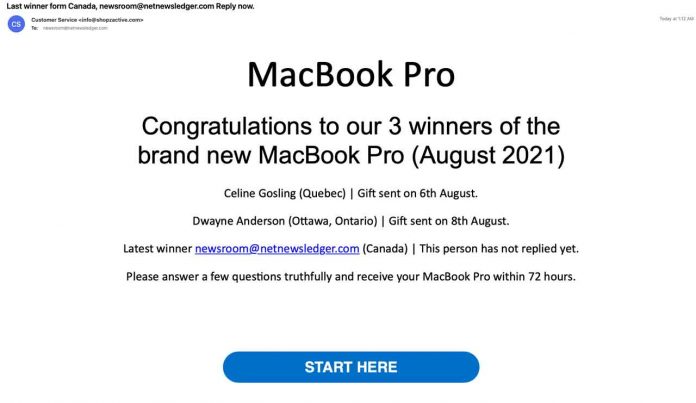

- Prize Notifications: Be skeptical of unexpected winnings that require upfront fees.

- Emergency Scams: Verify identities before responding to urgent money requests.

- Gift Cards: Treat gift cards like cash and avoid using them for payments.

- Charity Scams: Research charities and verify their registration before donating.

- Identity Theft and Fraud: Protect personal information and monitor financial statements.

TransUnion’s Analysis on Suspected Fraud Rates

- The rate of suspected fraudulent e-commerce transactions originating from Canada decreased to 1.21% during the Cyber Five shopping period.

- This rate contrasts with a higher 3.16% for the rest of 2023 leading up to this period.

- The reduction indicates a decline in suspected fraudulent activities during major shopping events.

Generational Differences and Fraud Types

- Younger generations, such as Gen Z (59%) and Millennials (53%), reported higher instances of being targeted by fraud, likely due to increased digital transaction activities.

- Apart from phishing, smishing, and vishing, other fraud schemes included money/gift card scams, identity theft, and unauthorized account access.

Consumer Action and Privacy Concerns

- A significant number of Canadians (48%) haven’t taken any action against cyber security threats due to uncertainty about appropriate measures.

- Identity theft, privacy invasion, and unsolicited marketing are the top concerns for Canadians sharing personal information.

- Credit report monitoring is a prevalent practice among Canadians, with 41% checking their scores at least monthly.

Patrick Boudreau, head of identity management and fraud systems at TransUnion Canada, highlights the increased risk of fraud during the holiday season. He advises vigilance against fraudsters who exploit the high-traffic shopping period for financial gain.

“The insidious aspect of these threats is fraudsters are playing the long game, often seeking to extract information on consumers they can use to build identities to gain access to credit,” said Boudreau. “Given the prevalence of fraudulent scams targeting Canadians, and the reality that fraudsters are ever more sophisticated and constantly evolving to attempt to overcome digital security measures, it’s critical Canadians take steps to protect themselves.”