Highlights:

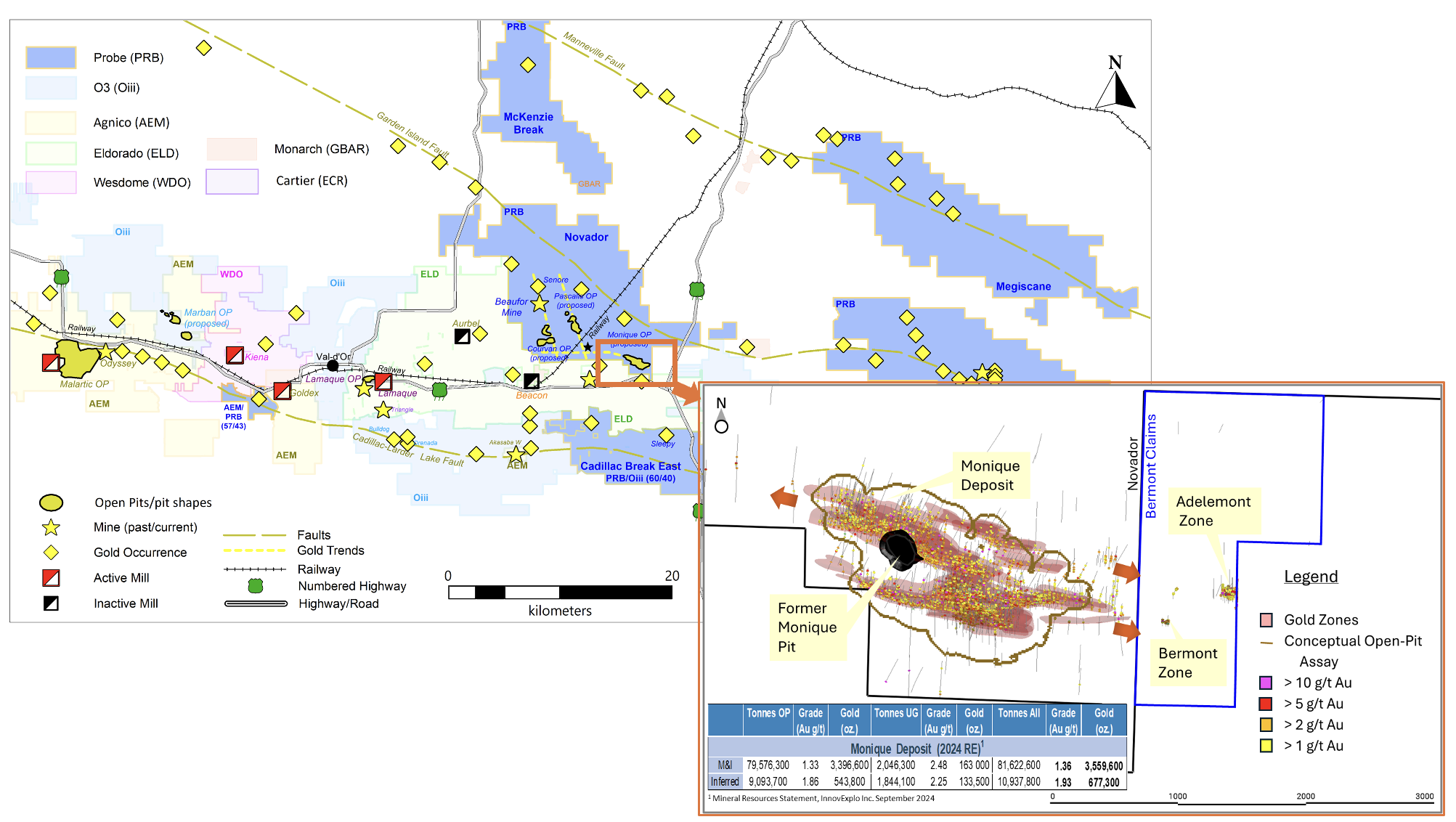

- Strategic Acquisition: the Property ties on to the eastern boundary of the current Monique Deposit and hosts an extra 750 metres of potential strike extension. The Monique resource currently has 3.56Mozs M&I and 0.68Mozs inferred delineated over 2,500 metres of strike length.

- Additional High-Grade Gold Zones: The property hosts the high-grade Bermont and Adelemont gold zones, which have seen limited drilling and remain open for expansion laterally and at depth. The gold mineralization and the geological setting are the same as the Monique deposit.

- Discovery Potential: No modern exploration has been done on the Property and few holes have been drilled under 200 metres. The Property has strong potential to host additional high-grade gold mineralization and has significant upside for new discoveries.

- Expanded surface area: The property adds additional room for surface mine infrastructure in the area of the Monique Pit, facilitating improvements in mine design and reduced costs.

- 2025 Planned Exploration Work: the company is planning resource expansion and exploration drill programs on the property for 2025.

TORONTO, Dec. 20, 2024 – Mining – PROBE GOLD INC. (TSX: PRB) (OTCQB: PROBF) (“Probe” or the “Company”) Probe Gold Inc. is pleased to announce that it has entered into a definitive purchase agreement (the “Agreement”) with Gestion Jadmine Inc. (“Jadmine”) to acquire a 100% interest in the Bermont Claims (the “Property”). The Property ties on to the eastern boundary of the current Monique Gold Deposit and provides 750 metres of potential extension of the gold trend to the east. The property spans 10 contiguous claims (the “Bermont Claims”) will be part of the Company’s Novador Development Project. High-grade zones within large envelope of gold have been intersected in historical drilling between 1945 to 2011 over the Bermont and the Adelemont zones located in an area in the southern part of the Property. The area has strong potential to host new gold resources adjacent to the Monique Deposit and has significant upside for new discoveries (Figure 1). The Company plans to begin exploration and resource expansion drilling program on the Property as part of its 2025 program.

David Palmer, President and CEO of Probe, states: “We are thrilled to announce the opportunity to acquire land directly along the trend of our multi-million-ounce resource at Monique. This acquisition not only enhances our exploration potential at Monique by 30%, it also unlocks the potential for higher-grade mineralization and new discoveries, while expanding the available surface area for critical operational infrastructure. This strategic addition brings immense value to both the Monique deposit and the Novador Development Project. We’re eager to advance exploration programs on this new land as soon as we begin our winter initiatives. This acquisition is the perfect way to cap off a year filled with remarkable achievements, and we’re excited to build on this momentum for an even more successful 2025.”

The transaction is expected to close in the coming weeks, subject to the receipt of all necessary regulatory and Toronto Stock Exchange (“TSX”) approvals, along with the satisfaction or waiver of other customary closing conditions.

Figure 1 – Probe Gold Val-d’Or Monique Deposit with the adjacent new Property

Transaction details

Pursuant to the Agreement, the Company will acquire a 100% interest in the Property for aggregate consideration of $3.0 million, to be paid to Jadmine as follows: (i) the issuance of common shares of the Company (the “Shares”) for a total value of $1,500,000, based on the 10-day volume-weighted average price (“VWAP”) of Probe’s common shares on the Toronto Stock Exchange on the day immediately preceding the closing date and (ii) a cash payment of $1,500,000. In addition, Probe will pay to Jadmine a milestone payment of $1,500,000, payable in cash or at the option of Probe, in common shares of the Company (the “Milestone Shares”) which will be paid upon confirmation of mineral resource calculation report prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects on the Property demonstrating totaling an inferred resource (or higher) of at least 1,000,000 ounces of gold (the “Resource Estimate”). Jadmine will retain a 3.5% net smelter return royalty (“NSR”) on the Property, of which 2.5% can be purchased by Probe, at any time, for $2,500,000. The Shares will be subject to a hold period of four months and one day from the date of issuance under applicable Canadian securities laws.

About the Bermont Claims Property

The Bermont Claims are adjacent to the Monique deposit, which hosts resources of 3,559,600 ounces M&I and 677,300 ounces inferred (see press release dated September 5, 2024). The Bermont and the Adelemont mineralized zones were formed contemporaneous to the Monique gold deposit and show similar characteristics. Gold mineralization is associated with deformation zones and porphyry dykes within mafic to ultramafic volcanics assemblage crossing the Property with an orientation of 280° and dipping – 80° to the north. Gold mineralization is defined by a network of quartz-tourmaline-carbonate veins and veinlets with disseminated sulphides in altered wall rocks.

The history of the Property dates to 1945, with the discovery of the Adelemont gold zone. The Property was subjected of exploration activities from 1945 to 2011, which consisted mainly in drilling the Adelemont and magnetic surveys covering the area. The Bermont zone was discovered in 2008 and very few holes were drilled into this zone. The most recent exploration drill program was in 2011 and returned intercepts grading up to 30.9 g/t Au over 1.6 metres, 5.7 g/t Au over 3.2 metres and 2.9 g/t Au over 4.0 metres.

Qualified Person

The scientific and technical content of this press release has been prepared, reviewed, and approved by Mr. Marc Ducharme, P.Geo, Vice President Exploration, who is a “Qualified Person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

About Probe’s Novador Project

Since 2016, Probe Gold has been consolidating its land position in the highly prospective Val-d’Or East area in the province of Quebec with a district-scale land package of 835 square kilometres that represents one of the largest land holdings in the Val-d’Or mining camp. The Novador project represents one property block of 205 square kilometres that hosts four past producing mines (Beliveau Mine, Bussiere Mine, Monique Mine and Beaufor Mine) and contains 80% of the Company’s gold resources in Val-d’Or East. Novador is situated in a politically stable and low-cost mining environment that hosts numerous active producers and mills.

About Probe Gold:

Probe Gold Inc. is a leading Canadian company focused on the acquisition, exploration, and development of highly prospective gold properties. The Company is well-funded and dedicated to exploring and developing high-quality gold projects. Notably, it owns 100% of its flagship asset, the multimillion-ounce Novador Gold Project in Quebec, as well as an early-stage Detour Gold Quebec project. Probe controls a large land package of approximately 1835-square-kilometres of exploration ground within some of the most prolific gold belts in Quebec. The Company’s recent Novador updated Preliminary Economic Assessment outlines a robust mining plan with an average annual gold production of 255,000 ounces over a 12.6-year mine life.

Val-d’Or properties include gold resources totaling 6,728,600 ounces in the Measured and Indicated category and 3,277,100 ounces in the Inferred category along all trends and deposits.

On behalf of Probe Gold Inc.,

Dr. David Palmer,

President & Chief Executive Officer

For further information:

Please visit our website at www.probegold.com or contact:

Seema Sindwani

Vice-President of Investor Relations

info@probegold.com

+1.416.777.9467

Forward Looking Statements

Neither TSX Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Exchange) accepts responsibility for the adequacy or accuracy of this release. This News Release includes certain “forward-looking statements” which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties, and other factors involved with forward-looking information could cause actual events, results, performance, prospects, and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the terms and conditions of the acquisition of the Property and the closing of such acquisition, that the Property has strong potential to host additional high-grade gold mineralization and has significant upside for new discoveries, the Company’s planned exploration activities, that the Property area has strong potential to host new gold resources adjacent to the Monique Deposit and has significant upside for new discoveries, the Company’s objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to the timely receipt of all regulatory and third party approvals for the acquisition of the Property, failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate First Nations and other indigenous peoples, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains, and those risks set out in the Company’s public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.