VANCOUVER, British Columbia, July 17, 2024 (GLOBE NEWSWIRE) — Saga Metals Corp. (“Saga” or the “Company”), a North American exploration company focused on critical mineral discovery in Canada, is pleased to announce that it has filed and obtained a receipt for its final long form prospectus dated July 11, 2024 (the “Prospectus”) in respect of its initial public offering (the “Offering”) from the securities regulatory authorities in British Columbia, Alberta and Ontario.

“This milestone marks a significant step forward for SAGA as we continue to expand our presence in the critical minerals sector,” stated Mike Stier, CEO & Director of Saga Metals Corp. He continued, “The TSXV listing is expected to enhance the Company’s visibility and accessibility to a broader base of investors, providing increased liquidity and support for our growth initiatives.”

Key Highlights for Investors:

- Final Prospectus: Receipt of the final prospectus signifies that Saga has met the necessary regulatory requirements and is poised for public trading.

- Conditional Approval: The conditional approval from the TSXV is a crucial step toward the official listing of Saga’s shares on the exchange.

- Strategic Growth: Listing on the TSXV aligns with Saga’s strategy to expand its investor base and secure the capital needed to advance its exploration projects in North America.

SAGA Metals Corp. is committed to maintaining high standards of corporate governance and transparency as it transitions to becoming a publicly listed company. This development will support the company’s ongoing efforts to discover and develop critical mineral resources in North America.

Please refer to the Prospectus, and the Company’s press release of July 15, 2024 (each available under the Company’s profile at www.sedarplus.ca) for more information about the Offering.

SAGA Metals Investment Highlights:

Focused on North America’s Critical Mineral Strategy – SAGA Metals is strategically concentrating on North America’s “Critical Mineral Strategy” with operations in two highly favorable jurisdictions: Labrador and Quebec, Canada.

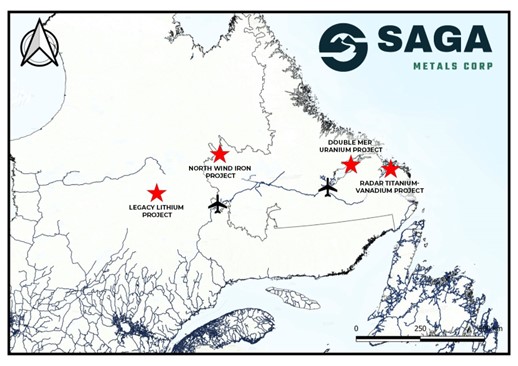

Map of SAGA Metals Projects

Diversified Critical Mineral Portfolio – SAGA’s portfolio spans five critical minerals across five projects of merit:

- Uranium: Double Mer Uranium Project, Labrador

- Lithium: Legacy Lithium Project and Amirault Lithium Project, James Bay, Quebec

- Titanium & Vanadium: Radar Titanium-Vanadium Project, Labrador

- Iron Ore: North Wind Iron Ore Project, Labrador

Key Project Highlights:

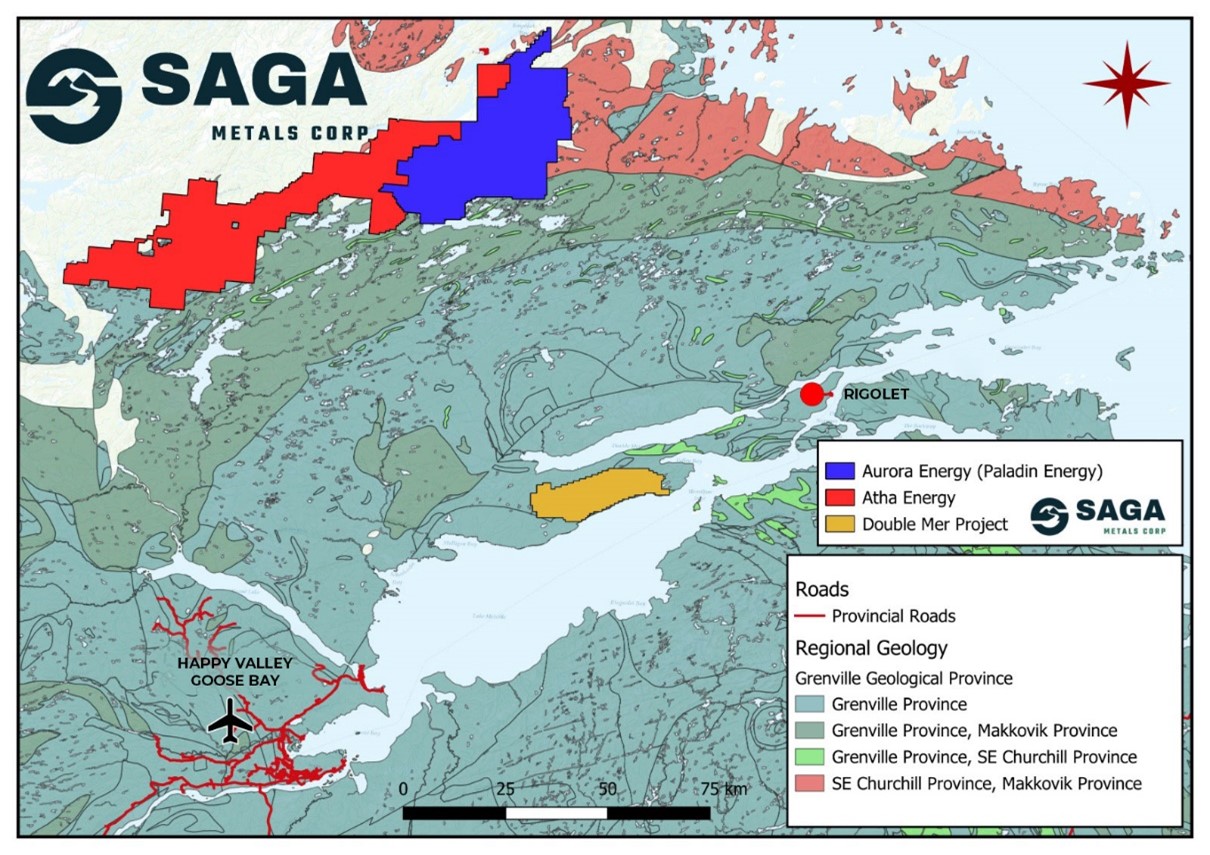

Double Mer Uranium Project

- Extensive exploration from 1970 to 2008 with considerable capital deployed in historical work on the property.

- Contains similarly linked geology to the Central Mineral Belt located just north of the property boundary and host to other notable Uranium projects including Atha Energy and Paladin Energy.

- 14 km strike of anomalous rock samples with results including 4,280ppm of Uranium and upwards of 21,000cps from the scintillometer.

- The Uranium radiometrics highlight an 18 km east-west linear trend averaging approximately 500 meters in width.

Regional map of the Double Mer Uranium Project in Labrador, Canada

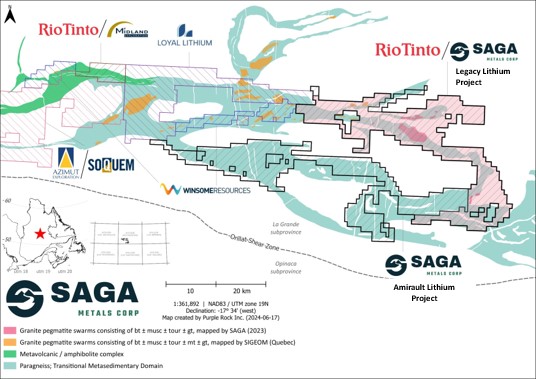

Legacy Lithium Project

- Partnership with Rio Tinto announced July 3, 2024: SAGA Metals Corp. Executes Option to Joint Venture with Rio Tinto Exploration Canada Inc. for Legacy Lithium Project

- The Legacy Lithium Project comprises 663 claims spanning 34,243 hectares, featuring 100 km of striking paragneiss and is located in Quebec’s Eeyou Istchee James Bay region.

- Key Terms of the Option Agreement with Rio Tinto:

- Under the Option Agreement, RTEC has the option to acquire an initial 51% interest (the “First Option”) in the Legacy Lithium Project over four years by meeting the following conditions:

- Cash Payments: Totaling C$410,190 on or before August 11, 2024.

- Exploration Expenditures: Totaling C$9,571,100, including a firm commitment of C$1,709,125 within the first 20 months.

- Additional Payments: C$273,460 to Saga (C$68,365 per year) and C$225,000 in aggregate to cover underlying claim acquisition amounts.

- After earning the initial 51% interest, RTEC has the option to increase its stake to 75% (the “Second Option”) over five years, following the four-year First Option term, by incurring an additional C$34,182,500 in exploration expenditures.

A map of the “Lithium Neighborhood” at the Legacy Lithium Project in Quebec

Amirault Lithium Project

- Acquisition positioned SAGA as the largest contiguous landowner in Eastern James Bay with 65,849 hectares

- Located adjacent to properties owned by Winsome Resources, Loyal Lithium, Azimut Exploration, and Rio Tinto

Radar Titanium & Vanadium Project

- Secondary project with a layered mafic intrusive body

- Numerous occurrences of massive magnetite showings

- Grades up to 6.63% titanium and 3,670 ppm vanadium

North Wind Iron Ore Project

- Secondary project with eight historic drill holes

- Part of New Millennium Iron’s 2013 resource estimate, grading over 20% iron oxide

Management and Future Prospects

SAGA boasts an experienced management team with expertise in capital markets and geology. The team focuses on maintaining a strong capital structure and acquiring quality projects based on robust geological assessments.

Upcoming Catalysts for Shareholders

Numerous catalysts are expected over the next 12 months as SAGA’s geological team has mobilized its summer exploration programs with news anticipated across all of SAGA’s projects in the coming weeks.

The Offering is being made on a best-efforts basis led by Research Capital Corporation, as sole agent and bookrunner (the “Agent”). Interested parties who wish to participate in the Offering should ask their investment advisor to contact the Agent for more information about the Offering and selling group participation at:

| Jovan Stupar email: jstupar@researchcapital.com; phone: 604-662-1808 Savio Chiu email: schiu@researchcapital.com; phone: 778-373-4088 |

||

In connection with the Offering, SAGA has received conditional approval from the TSX Venture Exchange (the “TSXV”) for listing of the Company’s common shares subject, to the fulfillment of the TSXV’s final listing requirements. Once final approval is received, the Common Shares will commence trading under the symbol “SAGA”.

The Company anticipates closing of the Offering to occur on or about July 29, 2024, subject to satisfaction of certain closing conditions, including, but not limited to satisfaction of the approval conditions of the TSXV for the listing of the common shares, among other things.

No securities regulatory authority has either approved or disapproved of the contents of this news release. The securities have not been, nor will they be, registered under the United States Securities Act of 1933, as amended, or any state securities laws, and may not be offered or sold in the United States, or to or for the account or benefit of any person in the United States, absent registration or an applicable exemption from the registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities in the United States, or in any other jurisdiction in which such offer, solicitation or sale would be unlawful.