TORONTO – Mining Press Release – Bunker Hill Mining Corp. (“Bunker Hill” or the “Company”) (TSXV: BNKR, OTCQB: BHLL) is pleased to provide an update on its Bunker Hill Mine located in Kellogg, Idaho. A call with the management is scheduled to be held on Tuesday, May 21st, 2024 at 8 a.m. (Pacific time) to provide an update and answer questions. Additional details regarding the call are available here:

“The start of our processing plant construction represents a vital and exciting milestone in our journey to restart the Bunker Hill Mine.” said Sam Ash, CEO, “We are on track for the planned start of both mining and mill commissioning by the end of this year, with the goal of ramping up to full production through Q1 2025”.

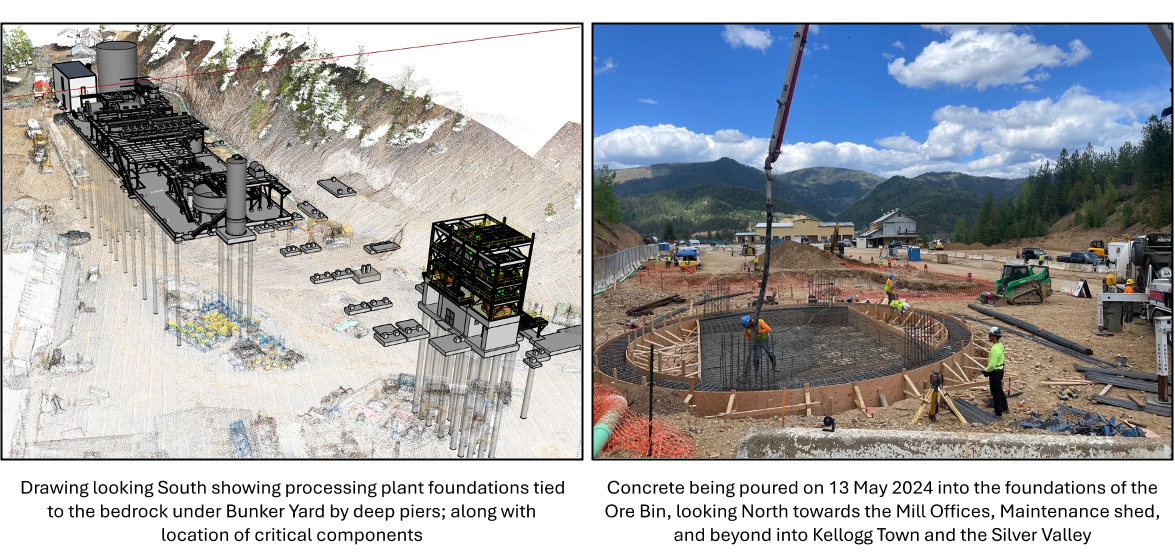

CONSTRUCTION STARTED OF THE CONCRETE FOUNDATIONS FOR THE PROCESSING PLANT

On April 30, 2024, the Company received its critical Pre-Permit to Construct from the Idaho Department of Environmental Quality (IDEQ), allowing the Company to start construction of its processing, and associated tailings management and mining facilities. This essential permission was granted following a detailed review of the Company’s Air Emissions Model and all its associated controls.

The Company is on track to start technical commissioning of the plant during Q4 2024. This will be concurrent with the planned start of mining and the building up of stockpiles; with the ramp up to full production through the first quarter of 2025.

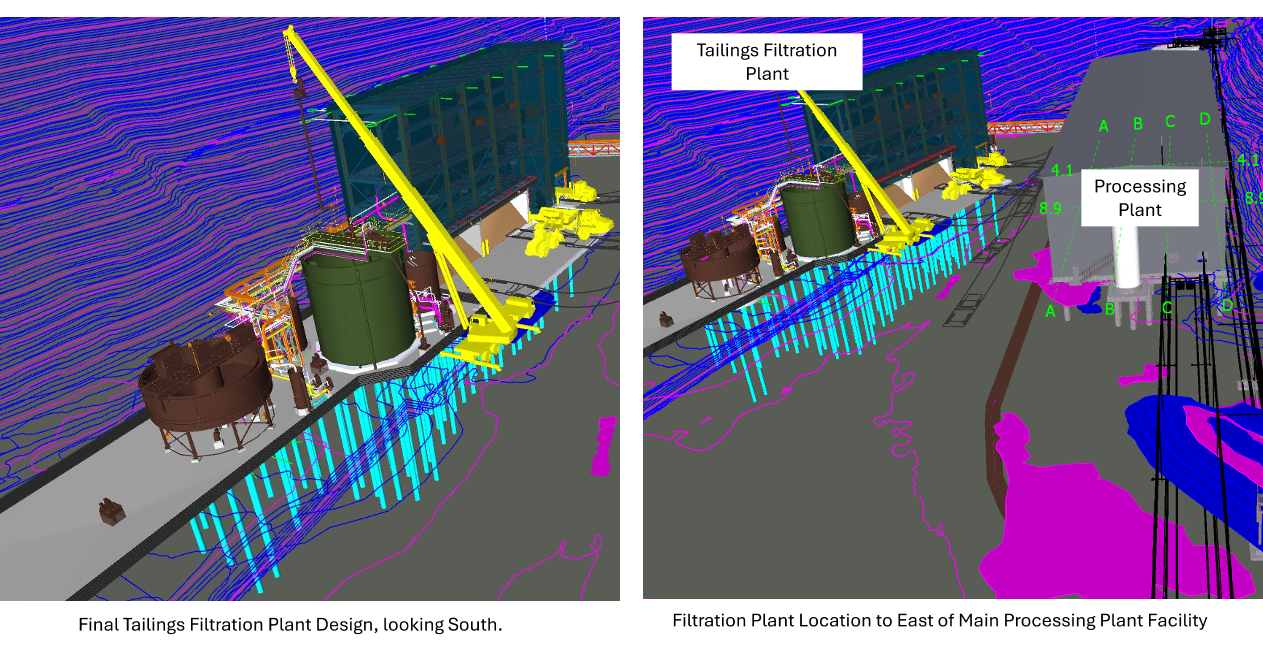

OPTIMIZED TAILINGS FILTRATION PLANT

After completing a detailed review of the Bunker Hill restart plant, the Company elected to optimize the Tailings Filtration Plant design to ensure both the highest possible standards of long-term environmental management and the ability to ramp up operations from 1800-2500 tpd over time.

This final design favored the more effective, but more expensive, pressure filtration system over the disk filter method considered in the Company’s preliminary feasibility study for the Bunker Hill Mine dated September 30, 2022 and reported in a news release dated October 18, 2022 that can be found here. The engineering for the new Filtration Plant has passed the 60% engineering milestone; with construction of the foundations intended to start in June 2024 following the setting of the deep piers.

The costs associated with the optimization of the Tails Filtration solution coupled with other key activities to de-risk the original design of the processing plant – specifically greater investment in deep pier stability, have been incorporated into a revised project budget and mining schedule. This optimization currently projects a marginal increase in the original ‘total cost-to-complete’ budget approved in Q1 2023, the start of mining in Q4 2024 with a ramp up to full production through Q1 2025. These adjustments have been incorporated into the on-going re-financing process, as detailed below.

RE-FINANCING UPDATE

The Company has been financing the project since H1 2023 using the US$67M financing package provided by Sprott Streaming. To improve projected free cashflow/share once the mine is in production, the Company has been conducting a re-financing process concurrent with advancing and thereby de-risking the total project plan. This aims to both lower the cost of project capital as well as increase the total quantum of capital available for the updated and de-risked project plan.

After three months, the company is pleased to report that this process has identified multiple suitable options, and a preferred solution with signed term sheet has been chosen. As a result, we have now moved into the execution phase and are on track to conclude this within the next 60 days. Additional details and progress updates will be provided in due course.

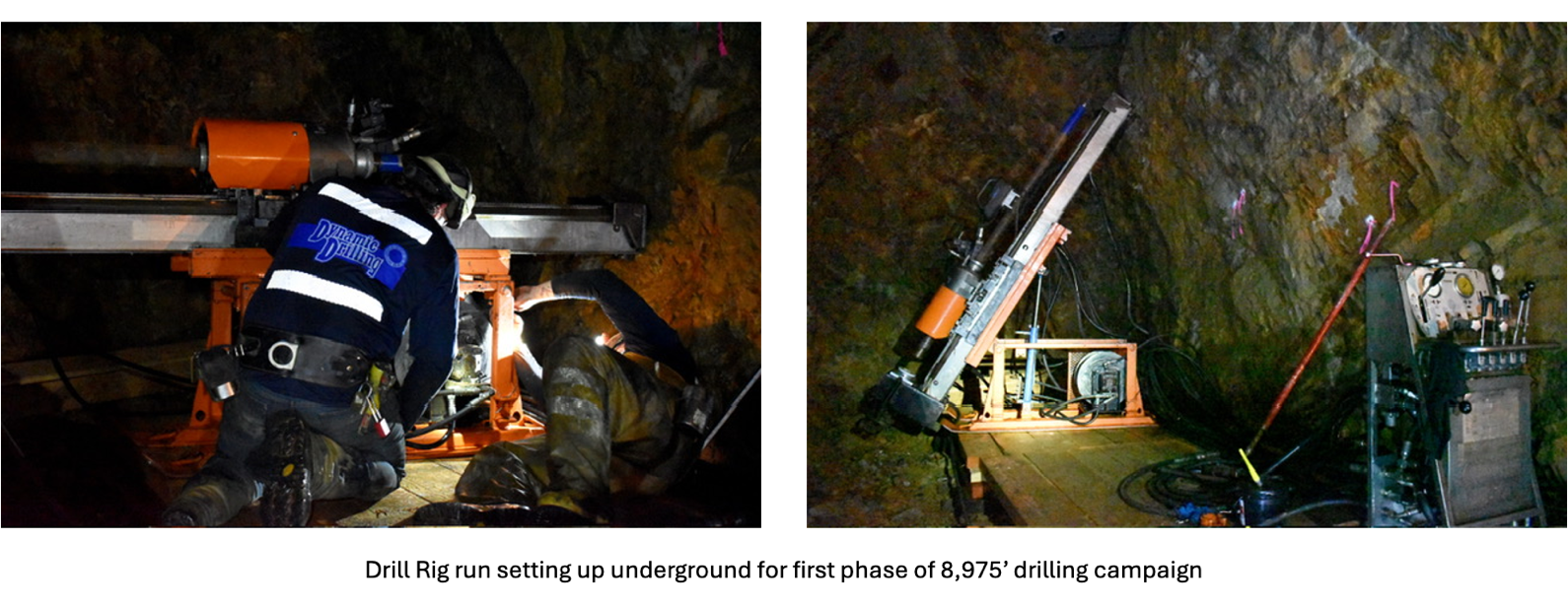

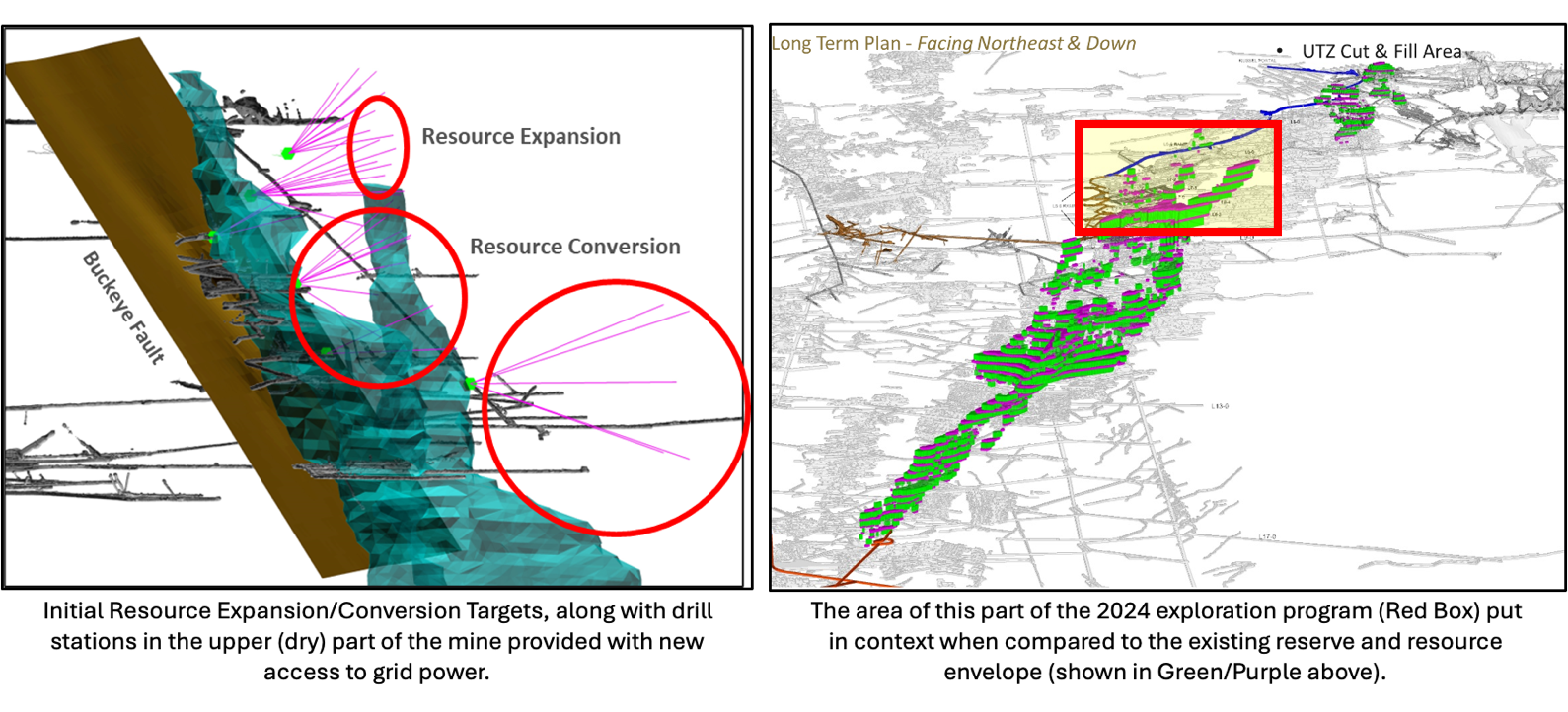

EXPLORATION DRILLING COMMENCEMENT

On May 10th, the Company initiated a resource expansion and exploration drilling program in support of the staged restart plan. This limited and precise program is fully funded within the existing restart budget. Over the coming months, 8,975 feet of core will be drilled from underground to further define and expand the existing resource. The initial drill targets are in close proximity to where the initial mining phase will take place.

This is the first phase of a staged, deliberate, multi-year exploration and resource expansion drill program, to be funded from operating cashflow when the mine is in production.

Qualified Person

Mr. Scott Wilson, is an independent “qualified person” as defined by NI 43-101 and is acting as the qualified person for the Company. He has reviewed, verified and approved the technical information summarized in this news release, including the sampling, preparation, security and analytical procedures underlying such information, and is not aware of any significant risks and uncertainties that could be expected to affect the reliability or confidence in the information discussed herein.”

About Bunker Hill Mining Corp.

Bunker Hill Mining intends to sustainably restart and develop the Bunker Hill Mine as the first step in consolidating and then optimizing several mining assets into a high-value portfolio of operations delivering critical metals into the market, initially focused on North America. Information about the Company is available on its website, www.bunkerhillmining.com, or the SEDAR+ and EDGAR databases.

On behalf of Bunker Hill Mining Corp.

Sam Ash

President and Chief Executive Officer

Bunker Hill Mining Contact:

Brenda Dayton

Vice President, Investor Relations

T: 604.417.7952

E: brenda.dayton@bunkerhillmining.com

Cautionary Statements

Neither the TSX Venture Exchange (the “TSX-V”) nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Certain statements in this news release are forward-looking and involve a number of risks and uncertainties. Such forward-looking statements are within the meaning of that term in Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended, as well as within the meaning of the phrase ‘forward-looking information’ in the Canadian Securities Administrators’ National Instrument 51-102 – Continuous Disclosure Obligations (collectively, “forward-looking statements”). Forward-looking statements are not comprised of historical facts. Forward-lookingstatements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result tooccur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, “plan” or variations of such words and phrases. Since forward-looking information are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these forward-looking statements are based on information currently available to the Company, the Company provides no assurances that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking statements.

Forward-looking statements in this news release include, but are not limited to, statements regarding the Company’s objectives, goals or future plans, including, without limitation: the restart and development of the Bunker Hill Mine operational construction and technical activities related to the planned restart and the expected benefits and timing thereof; planned exploration of drilling targets; estimates of total project costs; potential revenue opportunities from mining and sale of ore; and the Company seeking other value-creating opportunities.

Factors that could cause actual results to differ materially from such forward-looking statements include, but are not limited to, those risks and uncertainties identified in public filings made by Bunker Hill with the U.S. Securities and Exchange Commission (the “SEC”) and with applicable Canadian securities regulatory authorities, and the following: the Company’s inability to raise additional capital for project activities, including through equity financings, the execution of definitive loan documents with Monetary Metals and the expected timing of and reduction in cost of capital in connection therewith, concentrate offtake financings or otherwise; the fluctuating price of commodities; capital market conditions; restrictions on labor and its effects on international travel and supply chains; failure to identify mineral resources; failure to convert estimated mineral resources to reserves; the preliminary nature of metallurgical test results; the Company’s ability to restart and develop the Bunker Hill Mine and the risks of not basing a production decision on a feasibility study of mineral reserves demonstrating economic and technical viability, resulting in increased uncertainty due to multiple technical and economic risks of failure which are associated with this production decisionincluding, among others, areas that are analyzed in more detail in a feasibility study, such as applying economic analysis to resources and reserves, more detailed metallurgy and a number of specialized studies inareas such as mining and recovery methods, market analysis, and environmental and community impacts and, as a result, there may be an increased uncertainty of achieving any particular level of recovery ofminerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit, with no guarantee that production will begin as anticipated or at all or that anticipatedproduction costs will be achieved; failure to commence production would have a material adverse impact on the Company’s ability to generate revenue and cash flow to fund operations; failure to achieve theanticipated production costs would have a material adverse impact on the Company’s cash flow and future profitability; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; political risks; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; the inability of the Company to budget and manage its liquidity in light of thefailure to obtain additional financing, including the ability of the Company to complete the payments pursuant to the terms of the agreement to acquire the Bunker Hill Mine complex; inflation; changes in exchangerates; fluctuations in commodity prices; delays in the development of projects; and capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not beplaced on such statements or information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all, including as to whether or when the Company will achieve its project finance initiatives, or as to the actual size or terms of those financing initiatives. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Readers are cautioned that the foregoing risks and uncertainties are not exhaustive. Additional information on these and other risk factors that could affect the Company’s operations or financial results are included in the Company’s annual information form or annual report and may be accessed through the SEDAR+ website (www.sedarplus.ca) or through EDGAR on the SEC website (www.sec.gov), respectively.