TORONTO – “Meeting today’s climate challenges and retooling the economy requires significant business investment to decarbonize and build the net-zero industries and technologies of the future,” says Lucy Iacovelli, Canadian Managing Partner, Tax and Legal, KPMG in Canada. “To deliver, the federal government needs to make it fast and easy for companies to access the clean energy investment tax credits or they risk falling further behind the U.S. and other major economies. Canadian businesses are relying on this support to help ease the financial burden of emissions reduction and capitalize on these historic economic opportunities.”

Ahead of this year’s federal budget, nine in 10 Canadian business leaders want the federal government to make available all previously announced ‘green’ tax incentives and provide more support for their climate financing needs to transition to a clean, innovative economy, according to a new KPMG in Canada survey.

The survey of 534 small- and medium-sized businesses (SMBs) last month reveals that 83 per cent require more assistance and incentives to decarbonize, and 80 per cent support federal ‘green’ investments or incentives to attract foreign companies to locate in Canada.

- 90 per cent say all outstanding ‘clean economy’ business investment tax credits should be fast-tracked (e.g., for clean technologies/projects, clean energy, carbon capture etc.)

- 83 per cent say their organization needs more assistance/incentives to decarbonize

- 83 per cent believe Canada needs to do more to compete with U.S. climate policy funding, programs, and tax incentives (i.e., 2022 U.S. Inflation Reduction Act) to attract major clean/green investments

- 80 per cent support federal investments/incentives to attract foreign companies involved in electric vehicles, batteries, and clean technologies to locate in Canada

- 78 per cent agree that decarbonization will result in more jobs, growth and manufacturing in Canada

The federal government previously announced five major investment tax credits (ITCs) to help reduce climate-related costs and incentivize business investment. These ITCs offer incentives for investments in clean technology, clean hydrogen production, carbon capture, utilization, and storage (CCUS), clean technology manufacturing and clean electricity. The 2023 Fall Economic Statement provided updated timelines for implementation (including retroactive dates), with legislation for the CCUS and clean technology ITCs currently before Parliament. Further legislation for the remaining three ITCs is still required, possibly extending into 2025, says Ms. Iacovelli.

Nearly half of leaders say they are relying primarily on funding and incentive programs from both the federal government (46 per cent) and provincial government (46 per cent) to access the capital needed to finance emissions reduction. Additional key sources of funding were identified as internal financing, capital loans, institutional investors and private equity.

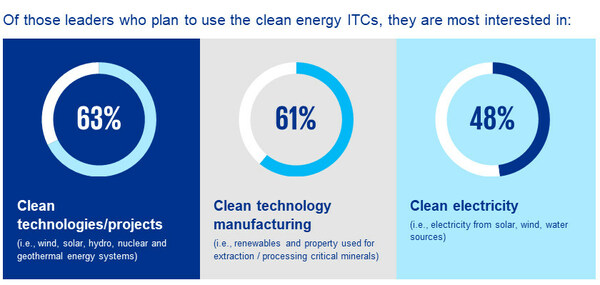

The poll findings reveal that nearly three quarters (74 per cent) plan to use the clean energy ITCs, of which well over a third (36 per cent) are relying on them to help finance decarbonization and the energy transition. Another one in five companies (38 per cent) would pursue the ITCs, but need more clarity about their eligibility. Only seven per cent have no plans to apply for or use the tax credits. The remaining 19 per cent are unsure if they could use them or not.

“Some business leaders are winning the race to decarbonize and are investing now to carve out exciting opportunities and compete in the future economy,” says Dino Infanti, Partner, National Leader, Private Enterprise Tax, KPMG in Canada. “However, the poll findings show that small- and medium-sized business leaders face unique barriers to financing decarbonization and qualifying for the tax incentives, whether it is a lack of up-front capital or the uncertainty and complexity involved in qualifying.”

Some incentives, such as the tax credit for carbon capture, are narrowly targeted to support specific types of activities and sectors − which needs to be made clearer to avoid some of the confusion, adds Mr. Infanti.

As the U.S. and other world economies enter an election cycle, 84 per cent agree that shifting geopolitical agendas will reshape climate change policies in the future.

“Given these uncertainties globally, this budget needs to create the conditions and investment climate for Canadian businesses to continue to move forward on meeting their net-zero commitments,” says Mr. Infanti. “The federal government’s current timetable should be accelerated, and the tax measures clarified to give businesses the help they need to decarbonize and transition to the new economy.”

While business leaders agree that more support for climate investment is required, there is also concern about federal government expenditures overall, with 89 per cent saying it is imperative that Canada’s finances are on a steady, sustainable track. Most leaders (89 per cent) believe it is critical that the federal government reduce the deficit and return the country to balanced budgets. Further, 86 per cent would prefer that the government implement policies and tax relief that support business growth, productivity and innovation, rather than spending more on individual taxpayer benefits.

KPMG in Canada surveyed 534 Canadian companies between February 3 and February 27, 2024, using Sago’s Methodify online research platform. All respondents are business owners or executive-level decision makers. Thirty-one per cent are leaders of companies with $500 million to $1 billion in annual gross revenue; 14 per cent, between $300 million to $499 million; 35 per cent, between $100 million and $299 million; 19 per cent, between $99 million to $10 million and the remaining one per cent, below $10 million. Seventy-five per cent of the companies are privately held and 25 per cent are publicly traded. Forty-two per cent are family-owned businesses.

KPMG LLP, a limited liability partnership, is a full-service Audit, Tax and Advisory firm owned and operated by Canadians. For over 150 years, our professionals have provided consulting, accounting, auditing, and tax services to Canadians, inspiring confidence, empowering change, and driving innovation. Guided by our core values of Integrity, Excellence, Courage, Together, For Better, KPMG employs more than 10,000 people in over 40 locations across Canada, serving private- and public-sector clients. KPMG is consistently ranked one of Canada’s top employers and one of the best places to work in the country.