Safeguarding Against Mortgage Fraud and Identity Theft

A new survey by Equifax Canada sheds light on a public increasingly worried about the potential rise in fraudulent activity across industries. In addition, Equifax Canada data shows mortgage fraud and identity fraud continuing to escalate across the country as economic pressure continue.

Key Overall Findings:

- Economy Fuels Fears: Over 76 per cent of Canadians surveyed believe financial hardships may increase the likelihood of people committing fraud and theft, suggesting economic anxieties may contribute to growing auto theft and identity fraud concerns.

- Auto Industry Alarm: Over 74 per cent of Canadians surveyed believe insurance fraud impacts their auto insurance payments, highlighting the financial burden of this growing crime. Over 56 per cent believe that keyless entry and ignition systems have increased the risk of auto theft, with 48 per cent knowing someone who has had their vehicle stolen.

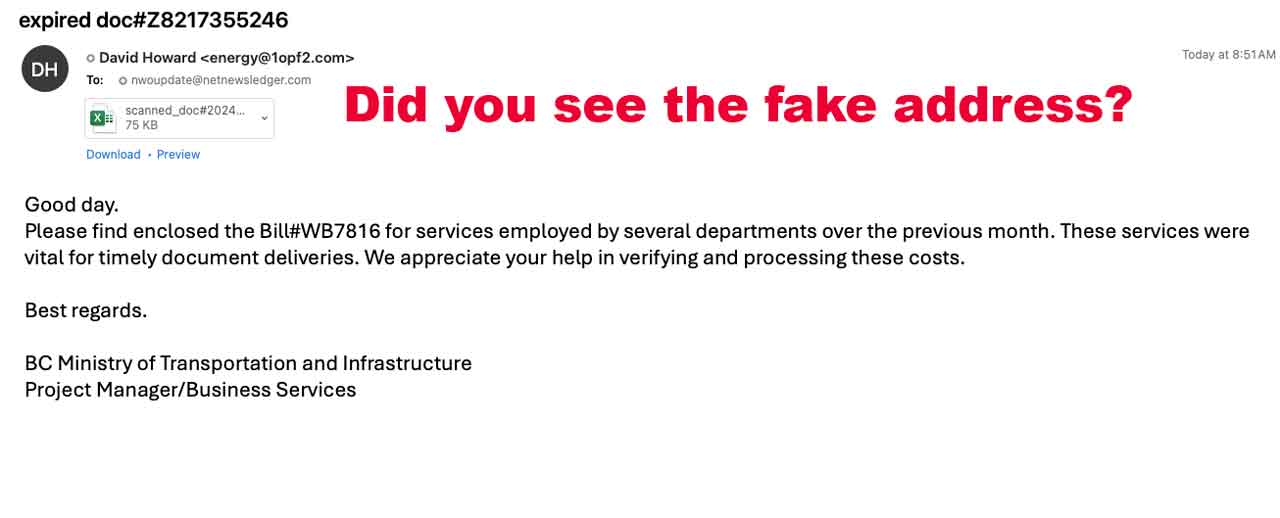

In really simple terms, don’t just click a link in an email. Start by looking at the email address. Often fraudsters use similar looking emails to what banks, online companies, and other businesses send. Take a second to look seriously at the email. Chances are you will see the phony ones in a hurry.

Second, “If it sounds too good to be true” – It probably is. That huge money gift or new iPhone 15 Pro Max you just won, really? Did you enter the contest? Take these seriously and give your head a shake over some of these scams.

It is hard enough making ends meet today in our economic and inflationary times. Don’t give your money, or your information away.

In the digital age, where personal information is increasingly stored and shared online, Canadians are facing heightened risks of mortgage fraud and identity theft. These nefarious activities can have devastating financial and emotional impacts on individuals and their families.

To combat this, it is crucial for Canadians to be proactive in adopting robust security measures to protect their personal and financial information. One effective strategy is to regularly monitor bank statements and credit reports for any unauthorized transactions or changes.

This awareness helps in early detection of fraud, enabling individuals to act swiftly to mitigate potential damages.

Implementing stringent security practices for personal and financial documents is also essential. Canadians should ensure that sensitive documents are stored securely, both physically and digitally.

Physical documents should be kept in a safe or locked cabinet, while digital files should be protected with strong, unique passwords and, where possible, two-factor authentication. Additionally, it’s important to be cautious when sharing personal information online or over the phone, especially with unsolicited requests.

Educating oneself about the common tactics used by fraudsters, such as phishing emails or fake loan offers, can significantly reduce the risk of falling victim to these scams.

Moreover, engaging with trusted financial institutions and legal professionals when dealing with mortgage transactions can provide an additional layer of security. These experts can offer valuable advice and help in navigating the complexities of mortgage agreements, ensuring that all transactions are legitimate and secure.

For Canadians, taking these proactive steps towards safeguarding their personal and financial information is not just a measure of precaution but a necessary practice in today’s digital landscape. By remaining vigilant and informed, individuals can protect themselves and their families from the potentially life-altering consequences of mortgage fraud and identity theft.

Equifax Data: Tracking Identity Fraud Across All Sectors

While overall fraud rates have seen a slight decline compared to the peak levels of 2022, the prevalence of identity fraud has increased. In the fourth quarter of 2023, identity fraud accounted for a staggering 75.21 per cent of all fraudulent applications across all sectors, marking a significant increase from 64.7 per cent in the previous year.

This rise in identity fraud poses a substantial risk to consumers and financial institutions alike, as fraudsters employ increasingly sophisticated tactics to exploit the system. The biggest proportion of identity fraud was seen in the banking sector, where 73.5 per cent of all fraudulent credit card applications and 89.3 per cent of all deposit frauds in Q4 2023 were found to be because of identity fraud.

“Identity fraud is no longer confined to traditional financial products; it has permeated into many industries including the auto industry, posing significant challenges for lenders and consumers,” said Carl Davies, Head of Fraud & Identity for Equifax Canada. “The rise in identity fraud rates illustrates the urgent need for enhanced security measures and greater vigilance across all sectors.”

Auto Industry

The Equifax application fraud data also suggests nearly 80 per cent of auto fraud cases involve first-party fraud, where individuals falsify income or financial statements when applying for a car loan. New data indicates that the proportion of identity fraud in auto fraud applications has doubled since 2019.

Secured lending institutions are especially vulnerable to these attacks, as fraudsters manipulate identity information to secure loans and acquire vehicles through deceptive means.

In response to these fraud trends, Equifax Canada emphasizes the importance of proactive fraud prevention measures and heightened consumer awareness. “As fraudsters adapt and evolve their tactics, it is imperative for consumers to remain vigilant and take proactive steps to protect themselves,” added Davies. “By staying informed and adopting robust security practices, individuals and businesses can help safeguard themselves.” Davies suggests businesses consider adopting a fraud prevention platform like FraudIQ Manager to protect their business.

Mortgage Woes

Equifax Canada quarterly data** also shows fraud rates in mortgage applications continue to rise, up by 9.9 per cent in Q4 compared to Q4 2022, with Ontario having the highest mortgage fraud rate among all the provinces. Mortgage fraud is most commonly seen in the form of first-party fraud, where an individual provides false information to qualify for a mortgage. “With consumers facing a difficult mortgage market and continued economic headwinds, we may see an increase in mortgage fraud,” cautioned Davies. “In our consumer survey, 64 per cent of respondents agreed that people are more likely to commit fraud or theft when they’re having a hard time making ends meet, such as providing false information on a mortgage application.”

Julie Kuzmic, Equifax Canada’s Senior Compliance Officer, Consumer Advocacy, encourages consumers to explore ID theft protection products that can help detect fraud sooner by alerting them to key changes on their credit reports and scores, as well as reviewing tips to protect their information, including:

- Using strong and unique passwords

- Being cautious of suspicious calls and emails

- Carefully disposing of sensitive documents like bank statements and credit card bills

- Being careful about sharing personal information and only sharing personal information and photo identification with trusted institutions

“Checking credit reports for suspicious activity offers a great opportunity to spot potentially fraudulent accounts, which Equifax can investigate at no charge,” Kuzmic explained. “You can request a free copy of your Equifax credit report by phone, mail, in person, and online.”

* Equifax surveyed 1,614 Canadians ages 18-65, Feb. 2-4. A probability sample of the same size would yield a margin of error of +/- 2.5 per cent, 19 times out of 20.

* *Equifax data pulled from Q4 2019 to Q4 2023

About Equifax

At Equifax (NYSE: EFX), we believe knowledge drives progress. As a global data, analytics, and technology company, we play an essential role in the global economy by helping financial institutions, companies, employers, and government agencies make critical decisions with greater confidence. Our unique blend of differentiated data, analytics, and cloud technology drives insights to power decisions to move people forward. Headquartered in Atlanta and supported by nearly 15,000 employees worldwide, Equifax operates or has investments in 24 countries in North America, Central and South America, Europe, and the Asia Pacific region. For more information, visit Equifax.ca.