In recent years, CapitalClique has emerged as a versatile player in the online brokerage industry, offering a range of trading services and platforms to a diverse clientele. This surge in visibility has led to numerous CapitalClique reviews, each shedding light on various aspects of its service offerings. Collectively, these reviews paint a picture of a platform that strives to cater to the needs of modern traders, from novices to experienced investors.

CapitalClique‘s approach to online trading is centered around providing a user-friendly interface complemented by a suite of tools designed to aid in effective market analysis and decision-making. The platform offers access to a wide array of financial instruments, including stocks, forex, commodities, and cryptocurrencies, aiming to provide traders with a comprehensive trading experience. Moreover, its commitment to incorporating advanced technology is evident in the continuous updates to its trading software, reflecting an awareness of evolving market dynamics and client needs.

As this review delves deeper into the specifics of CapitalClique’s offerings, it is important to consider the platform’s features, performance, customer support, and overall value proposition to its users. This introduction serves as a foundation to explore how CapitalClique positions itself within the competitive landscape of online brokerage firms.

CapitalClique Reviews: About the Broker

| General Information |

| Broker name | CapitalClique |

| Broker type | forex, indices, cryptocurrencies, stocks, commodities |

| Country | Switzerland |

| Address | Claridenstrasse 41, 8002 Zürich |

| Broker Status | Active |

| Customer Service |

| support@capitalclique.com | |

| Phone | UK: +442037509996

CA: +14388038030 |

| Availability | 24/5 |

| Trading |

| Trading Assets | 1500+ |

| Minimum Deposit | $250 |

| Leverage Up To | 1:300 |

| Educational Resources | Yes |

Navigating the Digital Trading Sphere: A Review of CapitalClique’s Platform

The broker, as reflected in various CapitalClique reviews, offers a trading platform that aims to stand out in the digital finance arena. This section delves into the intricacies of its platform, highlighting its distinct features, which cater to both novice and seasoned traders. The platform’s design philosophy seems to revolve around ease of use, cutting-edge technology, and providing actionable insights in real-time, all of which are crucial for making informed trading decisions.

User-Friendly Interface

The cornerstone of CapitalClique’s platform is its user-friendly interface. Designed with simplicity in mind, it allows traders of all levels to navigate the complex world of trading with ease. The interface is clean and intuitive, reducing the learning curve for new users while still offering the depth required by experienced traders. This approachable design extends to their mobile app as well, ensuring seamless trading on the go.

Real-Time Insights

CapitalClique’s platform offers real-time insights, a feature highly appreciated in many reviews. This aspect includes live market data, news feeds, and price alerts, ensuring that traders are always up-to-date with market changes. The platform’s integration of real-time analytics enables users to make timely and informed decisions, a key factor in the fast-paced world of online trading.

Advanced AI Algorithms

Incorporating advanced AI algorithms, CapitalClique’s platform stands at the forefront of technological innovation in trading. These algorithms assist in market analysis, trend prediction, and risk management, providing traders with a sophisticated toolset for better decision-making. The AI-driven features are particularly beneficial for identifying potential investment opportunities and creating personalized trading strategies, thus catering to the unique needs and goals of each trader.

CapitalClique’s trading platform, as illuminated by various reviews, appears to be a blend of user-centric design, real-time market insights, and advanced technological features, all working in unison to enhance the trading experience.

Safeguarding Your Investments: A Closer Look at CapitalClique’s Security Protocols

In an industry where security is paramount, the broker has garnered attention for its robust safety measures, as also noted in CapitalClique reviews. This section delves into the layers of security that CapitalClique has implemented to ensure the safety of its clients’ assets and personal information. These measures are critical in building and maintaining trader confidence in the platform.

Customer Asset Protection

One of the key aspects of CapitalClique’s security strategy is the protection of customer assets. This is achieved through regular stress tests and comprehensive security audits. These procedures help identify and mitigate potential vulnerabilities in their system, ensuring that clients’ investments are safeguarded against external threats and internal system failures. This proactive approach to security demonstrates CapitalClique’s commitment to maintaining a resilient trading environment.

Fortified Trading Environment

CapitalClique’s platform is designed to provide a fortified trading environment. This includes continuous monitoring of various risk factors such as purchasing power, order sizes, and profit/loss limits. By keeping a vigilant eye on these elements, the platform can promptly react to unusual activities or market anomalies, thereby protecting traders from unforeseen market volatility. This level of oversight is a testament to CapitalClique’s dedication to creating a stable trading environment.

Account Security

Recognizing the importance of individual account security, CapitalClique has implemented Two-Factor Authentication (2FA) for all user accounts. This additional layer of security requires users to verify their identity through a secondary device or application, significantly reducing the risk of unauthorized access. 2FA has become a standard security practice in the online financial services industry, and its inclusion in CapitalClique’s platform is a clear indication of its adherence to industry best practices in safeguarding user accounts.

In summary, the security measures employed by CapitalClique reveal a comprehensive approach to protecting client assets and information. From conducting regular security assessments to implementing advanced account protection features, CapitalClique demonstrates its commitment to creating a secure trading environment.

Tailoring Your Trading Experience: An Overview of CapitalClique’s Account Types

CapitalClique reviews discover the broker’s diverse range of account types caters to the varying needs and skills of traders. From beginners to the most seasoned investors, each account type is designed to provide specific features and services that enhance the trading experience. Here, we explore each account type and its unique offerings.

Self-Managed Account

The Self-Managed Account, with a minimum deposit of $250, is ideal for traders who prefer a hands-on approach. It offers 24/5 customer support and personal one-on-one sessions with a professional trader, providing a supportive learning environment. Leverage is capped at 1:5, and trading starts from 25 lots, making it suitable for those who are starting their trading journey and wish to manage their investments independently.

Silver Account

For a minimum deposit of $10,000, the Silver Account steps up with additional features. This account includes 24/5 customer support, introductory training sessions, and access to basic educational resources. The inclusion of an Unlimited 365 Trading Dashboard and the ability to trade sizes ranging from 0.01 to 100 lots, coupled with daily market news, makes it a solid choice for traders seeking to deepen their market understanding.

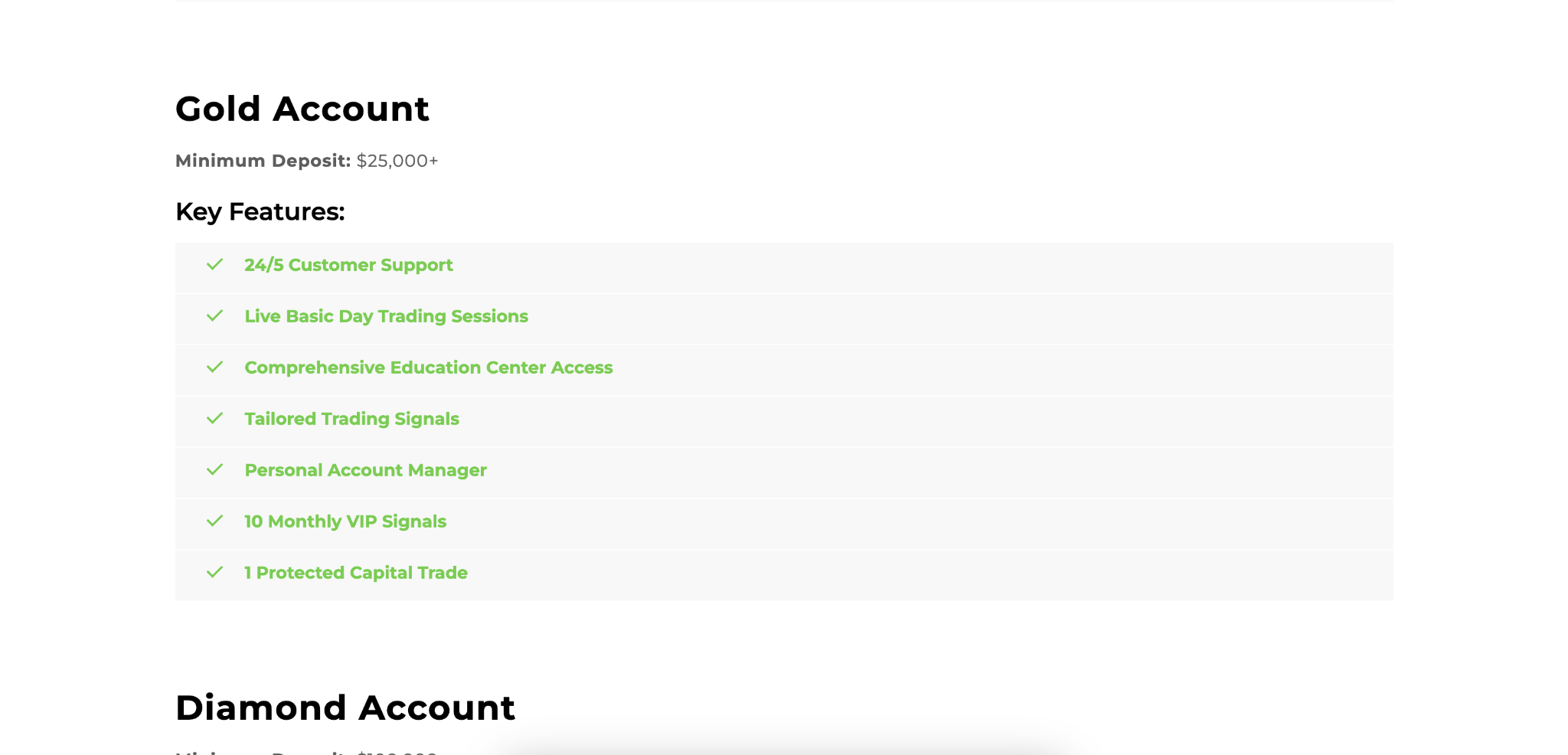

Gold Account

The Gold Account requires a minimum deposit of $25,000 and is designed for more experienced traders. It offers 24/5 customer support, live basic day trading sessions, and access to a comprehensive education center. Tailored trading signals, a personal account manager, 10 monthly VIP signals, and 1 protected capital trade are some of the key features that distinguish this account, providing a more personalized and in-depth trading experience.

Diamond Account

With a minimum deposit of $100,000, the Diamond Account is tailored for high-level investors. It provides 24/5 customer support, advanced training sessions, and full access to educational and trading resources. Features like a personal VIP account manager, unrestricted lot sizes, VIP desk daily signals, trading algorithm availability, preferential trading fees and conditions, and 10 protected capital trades set this account apart, offering a premium trading experience.

Palladium Account

The Palladium Account, requiring a minimum deposit of $250,000, offers an elite trading experience. It includes 24/5 customer support, customized training and analyst sessions, complete educational and trading signal access, and a VIP account manager. Members also enjoy exclusive Traders Group Club membership, private banking services, enhanced leverage at 1:300, trading insurance coverage, and priority hedging strategy access, providing a comprehensive suite of top-tier services.

Imperial Black (By Invitation Only)

For the most discerning investors, the Imperial Black account, with a minimum deposit of $500,000, represents the pinnacle of CapitalClique’s offerings. This exclusive account is available by personal invitation only and provides unparalleled services and privileges. Members of the Imperial Black account experience the highest level of personalized service and access to unique trading opportunities, reflecting CapitalClique’s commitment to catering to the needs of its most elite clientele.

CapitalClique’s range of account types demonstrates its commitment to providing tailored trading experiences. From the foundational Self-Managed Account to the exclusive Imperial Black, each account is designed to meet the specific needs and preferences of different types of traders.

CapitalClique Reviews: Summary

CapitalClique is a multifaceted online brokerage platform catering to a wide spectrum of traders with its varied account types, advanced trading platform, stringent security measures, and a commitment to customer education and support. The extensive CapitalClique reviews available online highlight the platform’s dedication to providing a comprehensive and secure trading experience, accommodating both novice traders and seasoned investors alike.

The diversity in account options, each with its own set of features and benefits, ensures that traders can find a suitable match for their individual trading style and experience level. From the beginner-friendly Self-Managed Account to the exclusive, by-invitation-only Imperial Black account, CapitalClique shows a keen understanding of its client base’s needs.

Important Notice: The purpose of this article is solely to inform. The author does not take responsibility for the company’s actions in relation to your trading experience. Be advised that the information might not be the latest or most accurate. Any decisions in trading or finance made based on this content are your own responsibility. We do not guarantee the correctness of this information and are not liable for any financial losses that result from trading or investing.