Federal Officials Explore New Measures to Curb Airbnb Operations, Following BC’s Lead

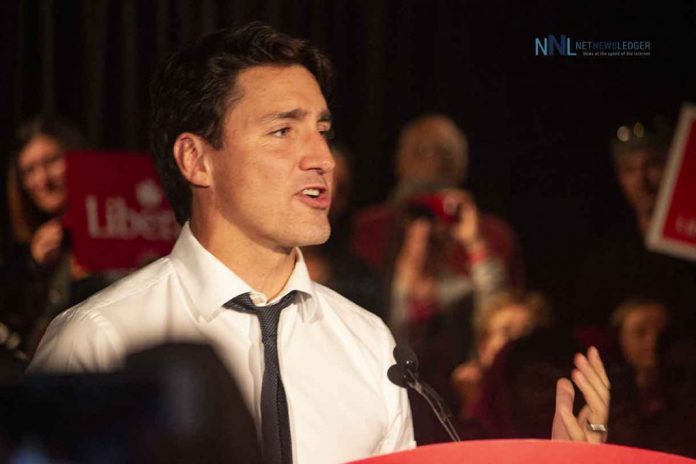

THUNDER BAY – NEWS – Prime Minister Justin Trudeau and the Liberal government is closely scrutinizing the operations of short-term rental platforms like Airbnb Inc. in a bid to mitigate the soaring rental and housing costs across the country. This initiative emerges as policymakers aim to quell inflation impacting the housing sector.

Potential Regulatory Framework Under Review

Finance Minister Chrystia Freeland divulged on Tuesday that the government is keen on identifying any laws or regulations that could potentially limit the operations of short-term rental platforms. These platforms offer temporary lodging for periods ranging from a few days to several weeks. Freeland lauded the province of British Columbia for its proactive stance—introducing proposed legislation to restrict many individuals from listing their investment properties on platforms like Airbnb and Flipkey.

Minister Freeland emphasized, during a press briefing in Ottawa, how such short-term rental services translate to fewer available homes for Canadians, particularly in densely populated urban areas. According to her, restricting these platforms could potentially free up as many as 30,000 more homes for rent in major cities like Toronto, Montreal, and Vancouver. The intent is to explore all viable federal tools that could significantly impact this sector, making housing more accessible.

For more information on Airbnb’s operations, visit Airbnb. Additionally, for insights on the ongoing legislative discussions, refer to the Government of Canada’s legislative webpage.

Airbnb Disputes Claims

Airbnb, while acknowledging the necessity for more housing supply, contested the notion that short-term rentals are a primary factor contributing to the current housing shortage. The San Francisco-based firm expressed its disapproval of the proposed BC law. According to Alex Howell, Airbnb’s Policy Manager for Canada, this legislation could potentially reduce the disposable income of British Columbians, hike travel costs for millions of provincial residents, and curtail tourism spending in communities where local hosts are often the sole providers of accommodation.

Rising Inflation and Rental Costs

The discourse around affordability gains prominence as Statistics Canada revealed that the consumer price index surged by 3.8% on an annual basis in September, albeit a slight dip from August’s 4% rate. The nation observed a 7.3% escalation in rents, with British Columbia, housing one of Canada’s priciest markets in Vancouver, witnessing an 8.4% increase.

Freeland, who also serves as the deputy prime minister, stopped short of specifying any immediate alterations the federal government intends to make concerning short-term rentals. Nonetheless, she voiced her approval should other provinces decide to emulate British Columbia’s approach.

The proposed British Columbia law is designed with exclusions for certain resort areas and municipalities with a population under 10,000.

How Could This Impact Housing and Investment?

The exploration of new regulatory measures concerning short-term rental platforms like Airbnb in Canada is an issue of significant importance due to several intertwined economic and social factors.

For many investors and landlords, the provincial laws governing rental property put their investment at risk. Issues with tenants going before rental tribunals is a real issue impacting property owners.

Here’s a breakdown of why this is a pivotal development and how it could potentially impact property investors:

- Housing Affordability and Availability:

- The crux of the matter lies in the housing affordability crisis many Canadians are facing, particularly in urban centers. The government’s initiative to possibly regulate short-term rentals is aimed at increasing the availability of long-term rental housing, which in turn, may alleviate some of the pressure on rental prices.

- Inflation Control:

- With the rising inflation rates, managing housing costs becomes a part of the broader economic stability strategy. By potentially converting short-term rentals to long-term housing options, there might be a moderation in the rapid increase in rental prices, which is a part of the inflation index.

- Property Investor Dynamics:

- For property investors, the dynamics could change considerably. Many investors purchase properties with the intention of listing them on short-term rental platforms to garner higher yields compared to traditional long-term leasing.

- If regulations curbing short-term rentals are implemented, the profitability model of such investments could be challenged. Investors might be required to switch to long-term leasing, which may offer lower returns.

- Market Value Implications:

- The potential legislation could also have implications on property values. If the short-term rental market shrinks due to regulatory constraints, the demand for investment properties might diminish, potentially affecting property values negatively.

- Provincial Legislation Variance:

- The variance in legislation from one province to another could create a complex landscape for investors operating in multiple provinces. For instance, the proposed law in British Columbia sets a precedent that if followed by other provinces, could create a patchwork of regulations affecting how and where investors allocate their resources.

- Capital Reallocation:

- Some investors might choose to reallocate their capital to other provinces or investment avenues where the regulatory environment is more favorable for short-term rentals.

- Tourism and Local Economy Impact:

- Besides affecting property investors, the regulation of short-term rentals could have a broader economic impact. The restrictions might deter tourism or increase the costs for tourists, potentially affecting local businesses and the economy.

- Investor Adaptability:

- Adaptive strategies would become crucial for property investors. Exploring alternative business models, like long-term rentals, or diversifying their investment portfolios to mitigate risks associated with regulatory changes would be imperative.

In conclusion, the discussion around regulating short-term rental platforms delves into a multifaceted issue encompassing housing affordability, investor interests, and broader economic implications. Property investors, in particular, may need to closely monitor legislative developments and be prepared to adapt their strategies accordingly.