Gold has taken a hit and investors are rightly worried that their gold investments will not be able to recover. This is the right time to take a long-term view on gold and look at the fundamentals.

Stagflation is Coming

The World Bank recently reported that it expects a return to 1970s style stagflation, a state of affairs characterized by stagnant economic activity, and high inflation. The last time the world had stagflation, gold was the best performing asset class. Economist Nouriel Roubini has warned over stagflation for some time, pointing to shocks such as the pandemic, China’s zero-Covid policy-related city-wide shut downs, Russia’s invasion of Ukraine, the Sino-US standoff, and a general de-globalization that has taken hold, with protectionism taking hold and companies reshoring to more expensive production centers. None of these things are going away any time soon. A looming debt crisis adds a further layer of risk to the global economy. Quite simply, the conditions are ripe for gold to outperform.

Gold is Undervalued

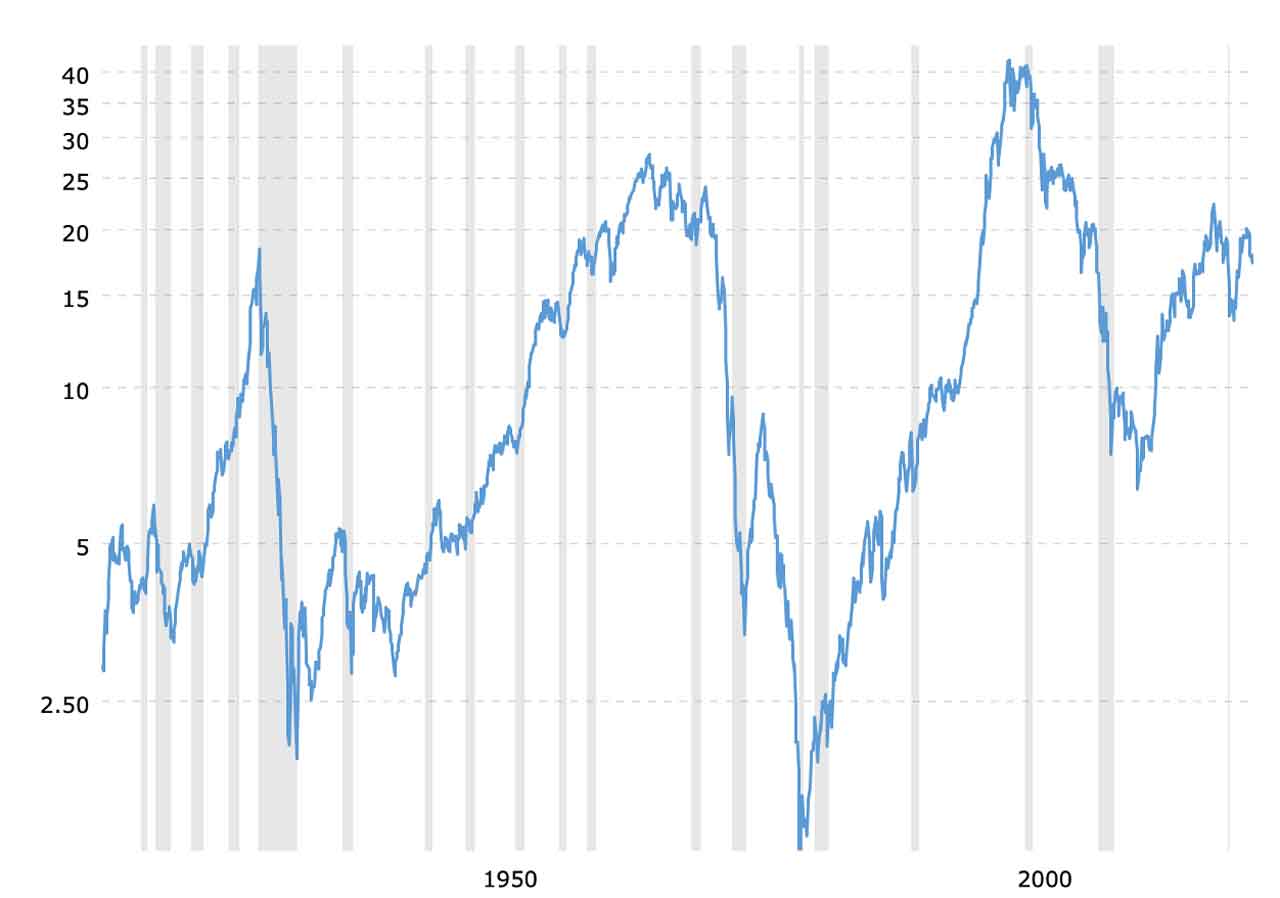

A crucial fact is that gold is still undervalued. Traditionally, the Dow Jones Index/Gold ratio has been a good indicator of gold’s valuation. The higher the ratio, the more undervalued gold is. Today, the ratio is near-18, compared to the 1960s and 1990s when it was over 20.

Source: Macrotrends

Higher ratios have been followed by high gold prices, as the chart below shows.

Source: Macrotrends

Basically, there is a direct relationship between a rise in the Dow/Gold ratio and subsequent gold prices. What this should tell investors is that gold is undervalued and poised for higher prices.

Gold Miners Have Been Disciplined

Gold has traditionally been a very cyclical industry. This is due to the commodity nature of the industry. In response to rising gold prices, gold miners have typically raised more capital (in the form of both debt and equity), increased capital expenditure and taken production high until it has reached excess supply. At that point, the gold price pops, and gold miners have been left with debt they struggle to service, unprofitable shafts, some mines go into bankruptcy, and capital expenditure has been forced to decline. This occurs until profitability returns to the industry once supply has reached a market clearing level. The growth in assets is inversely related to future stock performance. So, gold miners have followed asset growth with poor stock performance.

Since the last great gold bubble, gold miners have deleveraged, reduced capital expenditure and become more disciplined in terms of capital allocation. In fact, even though capital expenditure is expected to rise in 2022, it remains far short of capital expenditure just 5 or 6 years ago, leading to some analysts worrying that capital expenditure levels are not high enough to meet demand. The impact of this is that gold miners will be more profitable during this next phase when gold is likely to increase in value.

Conclusion

Thus, investors should stay the court and increase exposure to physical gold, gold exchange traded funds (ETFs), gold stocks, and have a gold IRA company in their portfolio. The ingredients are there for gold to outperform.