Exchange traded funds (ETF) are securities that track a sector, commodity, or an index. Unlike mutual funds that can only be traded once a day, Exchange traded funds (ETF) prices fluctuate all day, much like specific stocks being exchanged on the stock market.

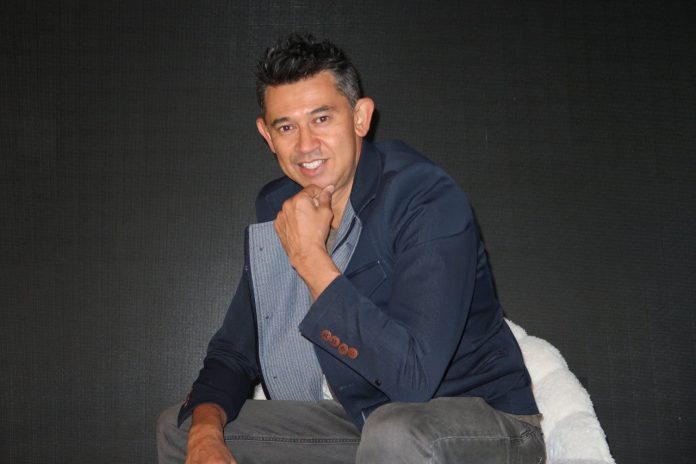

According to veteran investor Darren Herft, ETFs have opened a new vista for investors as they can be traded on most stock exchanges in the same way as regular stocks.

“Exchange traded funds (ETF) can be organised to track a diverse array of investments, ranging from individual commodity prices to any number of securities,” says the Australian entrepreneur.

“They can be designed to track investment strategies!” he adds.

Darren Herft believes that the lower expense ratios coupled with lower brokerage fees makes them a lucrative option for investors looking to diversify their holdings.

“For investors looking for more liquidity, Exchange traded funds (ETF) provide a better avenue than mutual funds,” says Darren Herft.

He believes that in many ways, Exchange traded funds (ETF) hold an edge above stocks.

Darren Herft says, “Rather than holding only one asset like a stock, Exchange traded funds (ETF) hold multiple assets and that has helped their popularity.”

A single Exchange traded fund (ETF) could have numerous stocks under its umbrella. While some are nationally focused, others are global.

Darren Herft says that even within the Exchange traded fund (ETF) world, there are various options for investors to consider.

“Their utility can range from income generation to hedging or partly offsetting risks in an investor’s arsenal,” says Herft.

He thinks that more fiscally conservative investors might find Bond Exchange traded funds (ETF) to be suited to their needs and temperament. Bond Exchange traded funds (ETF) provide regular income to their holders depending upon the performance of the bonds under their umbrella.

“Bond ETFs could have government bonds, corporate bonds or municipal bonds in their ambit and unlike bonds, they don’t have a maturity date,” says Herft.

Herft says that more risk-tolerant investors might find their match in Stock Exchange traded funds (ETF). Consisting of a basket of stocks that track a whole sector or industry, they provide an investor with a uniquely diverse portfolio with established high performers coupled with newer stocks with growth potential.

“It’s a good collection of stocks and investors don’t have to worry about high fees associated with stock mutual funds,” adds Herft.

Other types of Exchange traded funds (ETF) include Industry ETFs, Commodity ETFs, Currency ETFs, and Inverse ETFs. Herft thinks that the most attractive quality of this investment vehicle is its ability to be diverse and specialized at the same time.

While the AFL aficionado believes that Exchange traded funds (ETF) can be a useful vehicle for many investors, he is of the opinion that they should not be put on a pedestal.

“As with any investment, there are pros and cons and I would recommend anyone looking to invest in anything to do their own independent research and consult experts if they can, before making a decision,” he adds.

![Fin2ai Review: How to automate Forex Trading with AI [fin2a-i.com] Fin2ai Review: How to automate Forex Trading with AI](https://www.netnewsledger.com/wp-content/uploads/2024/09/Fin-Zol-Bitcoin-and-more-218x150.jpg)