-

Noront Board of Directors unanimously determines improved Wyloo Metals Offer of C$1.10 per share to be a Superior Proposal

-

Improved Wyloo Offer of C$1.10 in cash per share represents a 358% premium to Noront’s unaffected closing price on May 21, 2021 and a 47% premium to BHP’s C$0.75 per share offer

-

BHP has five business days to match Wyloo Metals’ offer

TORONTO – Mining – Noront Resources Ltd. (“Noront” or the “Company“) (TSXV: NOT) today announced it has settled an arrangement agreement (the “Arrangement Agreement“) with Wyloo Metals Pty Ltd and Wyloo Canada Holdings Pty Ltd (together, “Wyloo Metals“) under which Wyloo Metals has agreed to acquire up to all of the issued and outstanding common shares of Noront (“Common Shares“) that it does not already own, directly or indirectly, for C$1.10 per Common Share by way of a statutory plan of arrangement under the Business Corporation Act (Ontario) (the “Wyloo Offer“).

Under the Arrangement Agreement, shareholders must make an election to sell (a “Sale Election“) all or a portion of their Common Shares to Wyloo Metals in order to receive cash consideration of C$1.10 per Common Share. Shareholders who do not make a Sale Election will retain their Common Shares following the closing of the Transaction. Notwithstanding the foregoing, Wyloo Metals will have an option to acquire all of the Common Shares that it does not already own, directly or indirectly, for C$1.10 per Common Share – including those Common Shares not subject to a Sale Election – if less than 10% of the outstanding Common Shares are not subject to a Sale Election.

The consideration of C$1.10 in cash per share under the Wyloo Offer represents an approximate 358% premium to the unaffected closing price of the Common Shares on May 21, 2021 and an approximate 47% premium to the cash offer of C$0.75 per Common Share (the “BHP Offer“) made by BHP Western Mining Resources International Pty Ltd (“BHP“).

BHP Right to Match

Pursuant to the terms of the support agreement among Noront, BHP and BHP Lonsdale Investments Pty Ltd (the “Support Agreement”), upon the Company making a determination that a superior proposal has been received, BHP has the right, but not the obligation, to offer to amend the terms of the BHP Offer. BHP has five business days from receiving notice of the superior proposal in accordance with the terms of the Support Agreement to negotiate with Noront, should BHP decide to do so, to amend the terms of the existing Support Agreement such that the Wyloo Offer is no longer considered by the Noront Board of Directors to be superior to the amended BHP offer.

If BHP does not exercise its right to match within the period provided for in the Support Agreement and Noront terminates the Support Agreement, or the Support Agreement is otherwise terminated in accordance with its terms for any reason, then the Arrangement Agreement will be immediately entered into by the Company and Wyloo Metals.

If the Arrangement Agreement is going to be entered into, Wyloo Metals has also agreed to provide a loan to Noront of up to C$29.38 million (the “Wyloo Loan“) to finance, among other things, the termination payment of C$17.78 million payable to BHP upon the termination of the Support Agreement, as well as other transaction related costs. The term of the Wyloo Loan will be 12 months from completion of the Wyloo Metals transaction, with interest of 5% per annum payable quarterly in either cash or common shares of Noront, at the option of Noront and subject to receiving shareholder approval for the payment of interest in common shares of Noront, and subject to the approval of the TSX Venture Exchange.

It is expected that, if the Support Agreement is terminated, certain Noront shareholders, including Noront directors and senior management, will enter into lock-up agreements under which they will agree to vote in support of the Wyloo Offer. Wyloo Metals currently holds approximately 37.2% of the outstanding Common Shares (on a basic basis).

The terms of the Arrangement Agreement, if executed, will provide that Wyloo Metals will be entitled to a termination payment of C$26 million (equal to approximately 4% of the total equity value of the transaction based on 100% of Noront’s fully diluted shares outstanding) if the Arrangement Agreement is terminated in certain circumstances. This termination payment will not be payable if BHP elects to match the Wyloo Offer and Noront and Wyloo Metals therefore do not enter into the Arrangement Agreement.

There is no action for Noront shareholders to take today. If Noront enters into an Arrangement Agreement with Wyloo Metals, additional information will be provided to Noront shareholders in advance of a Special Meeting of Shareholders to vote on the plan of arrangement. The applicable materials will also be available on SEDAR (www.sedar.com) under Noront’s issuer profile and on Noront’s corporate website (www.norontresources.com).

The entering into of the Wyloo Loan between Wyloo Metals and Noront, is considered to be a “related party transaction” for purposes of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”) as Wyloo Metals has beneficial ownership of, and control or direction over, directly or indirectly, securities of the Company carrying more than 20% of the voting rights attached to all of Noront’s outstanding voting securities. The Company did not file the material change report more than 21 days before the expected completion of the Wyloo Loan as the details of the Wyloo Loan were not settled until shortly prior to the announcement of the Wyloo Loan. The Company is relying on exemptions from the formal valuation and minority shareholder approval requirements available under MI 61-101. The Company is exempt from the formal valuation requirement in section 5.4 of MI 61-101 in reliance on section 5.5(b) of MI 61-101 as the Company is not listed on a specified market under MI 61-101. Additionally, the Company is exempt from minority shareholder approval requirement in section 5.6 of MI 61-101 in reliance on section 5.7(f) of MI 61-101.

Advisors

TD Securities Inc. is acting as financial advisor, Bennett Jones LLP is acting as legal counsel and Longview Communications & Public Affairs is acting as communications advisor to Noront.

About Noront Resources

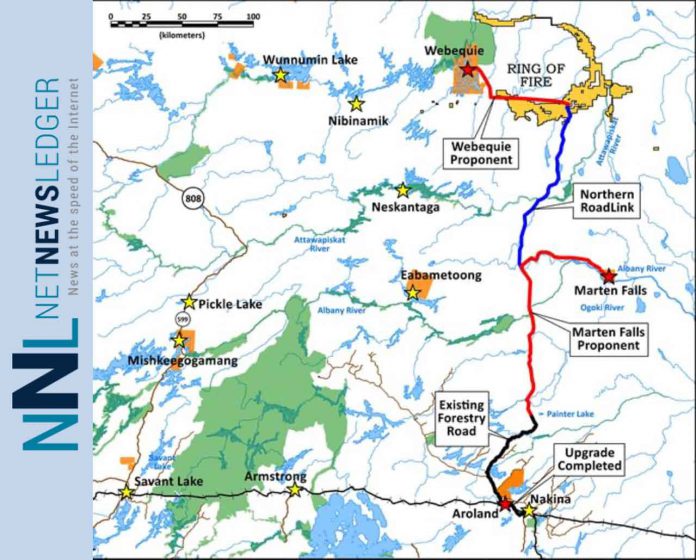

Noront Resources Ltd. is focused on the development of its high-grade Eagle’s Nest nickel, copper, platinum and palladium deposit and the world class chromite deposits including Blackbird, Black Thor, and Big Daddy, all of which are located in the James Bay Lowlands of Ontario in an emerging metals camp known as the Ring of Fire. www.norontresources.com