Recovery from Pandemic will Take New Thinking and Support from Governments

THUNDER BAY – Small to medium-sized businesses are going to need help getting back on their feet following the pandemic shutdown. Across Canada, there are “Shop Canadian” efforts, shop local, and staycations being suggested.

Online shopping has seen increased volumes, and shipping companies are continuing to see record volumes. It is very likely there is going to be a lot of people who have and will continue to shop online. This will mean changes for bricks and mortar shops.

According to the Canadian Federation for Independent Business, sales for small businesses are at very low numbers, and recovery is slow. If there is the feared ‘Second Wave’ with COVID-19, the impact on small businesses is going to be especially hard.

It likely means that the COVID-19 pandemic will have been the impetus for a business shift to the Internet. Additionally, it means that getting online for business, offering online shopping, especially in Western and Northern Ontario is going to be key to future success.

“In Thunder Bay, retail, accommodations, and food services positions make up over 22% of our total labour market. The closure of restaurants and storefronts on top of provincial travel restrictions have hit our community hard. I expect these numbers to begin to show improvement in June and July as restrictions are lifted and I am encouraged by early feedback from some individual businesses that are already seeing positive results from their efforts to reimagine their services and delivery models, “ states Charla Robinson, President of the Chamber of Commerce.

Moving forward small businesses face challenges. There are extra costs needed for cleaning supplies, lexan shields, staff training, and in some cases finding workers. While there are some workers seemingly content to take the CERB, others are simply concerned over the impact healthwise from the virus.

What are the national numbers saying?

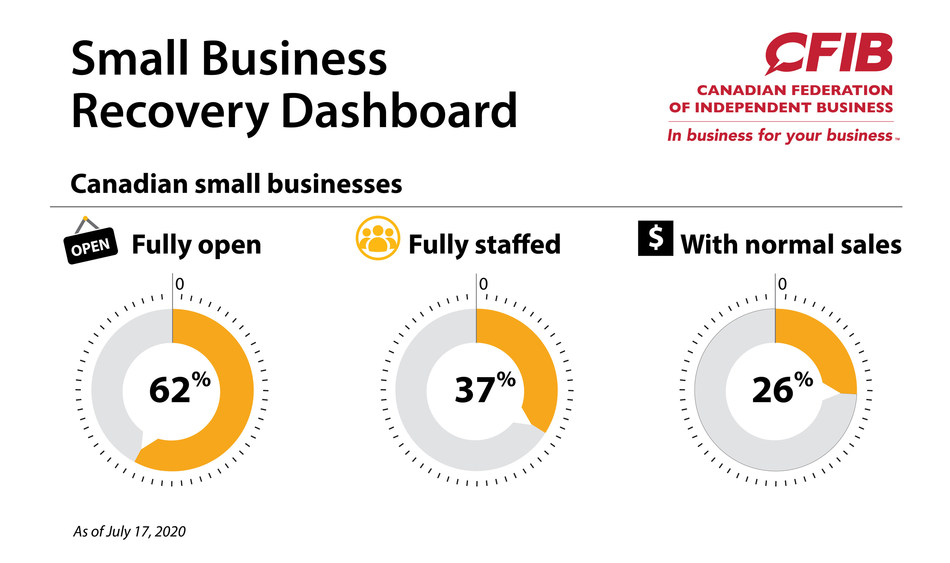

New data shows payment methods at small businesses have shifted away from cash toward electronic options like credit, debit, and Interac e-Transfer®. Despite this shift, sales remain concerningly low for this time of year, according to the latest data on the Canadian Federation of Independent Business (CFIB)’s Small Business Recovery Dashboard, part of its #SmallBusinessEveryDay campaign.

Small business recovery ticked up slightly with 62 percent of small businesses fully open (58 percent last week), 37 percent fully staffed (35 percent last week), and 26 percent making normal sales (24 percent last week). Additional data from Chase Merchant Services shows credit and debit card sales for Canadian small businesses are on average 25 percent lower for March-June 2020 than the same time in 2019. Monthly credit and debit sales have improved since lows seen earlier this year in April when more businesses were closed (April was 40 percent lower, May was 25 percent lower and June was 15 percent lower than in 2019).

“While consumer spending through credit and debit seems to be improving, the broader picture shows that there has been a shift in payment methods and sales remain at perilous levels for many businesses,” said Corinne Pohlmann, Senior Vice-President at CFIB.

One in three small business owners reports they have increased their use of credit cards and Interac e-transfer as a method of getting and making payments, and one in four have increased their use of debit cards, while 38 percent have decreased their use of cash since the pandemic started and seven percent have stopped using cash altogether.

“Things are slowly getting better, but small businesses depend on Canadians to choose local so the hardware store down the street, the independent pet shop, the mom and pop bakery can survive. This is what the #SmallBusinessEveryDay campaign is all about. We urge everyone to be mindful of where they spend in the coming months and to choose a small, independent business every chance they get,” continued Pohlmann.

Since CFIB launched smallbusinesseveryday.ca, thousands of Canadians have taken the challenge to support independent businesses. CFIB is also profiling other initiatives across the country that support small business recovery, like The Big Spend, which encourages Canadians to make the conscious choice to spend at small businesses on July 25.

Solutions for Small Business

Digital Main Street

“As local economies across Ontario reopen, we’re focused on ensuring that our main streets don’t just survive, but thrive,” said Mélanie Joly, Canada’s Minister of Economic Development and Official Languages and Minister responsible for the Federal Economic Development Agency for Southern Ontario.”These businesses are the backbone of our economy, a source of local jobs – and local pride. Thanks to the expanded Digital Main Street platform, they’ll be able to expand their offerings and take advantage of more and more people shopping online. Our message to Ontario’s small businesses and those whose livelihoods rely on them is clear: we’re working with you to support good jobs and help our economy come back stronger than ever.”

“The global marketplace is rapidly changing, and in order to compete and succeed Ontario must adapt,” said Vic Fedeli, Minister of Economic Development, Job Creation and Trade. “By using innovative tools and technologies, Digital Main Street will help our businesses in expanding their reach to meet new markets and adjust to the new realities of doing business during the pandemic and into the next phase of economic recovery.”

INNOVATION

Thunder Bay Chamber of Commerce President Charla Robinson says, “There are going to continue to be massive shifts in the market and some business models won’t work in the new world. Innovation will be key to survival.”