The C. D. Howe Institute states Business Property Taxes a Burden

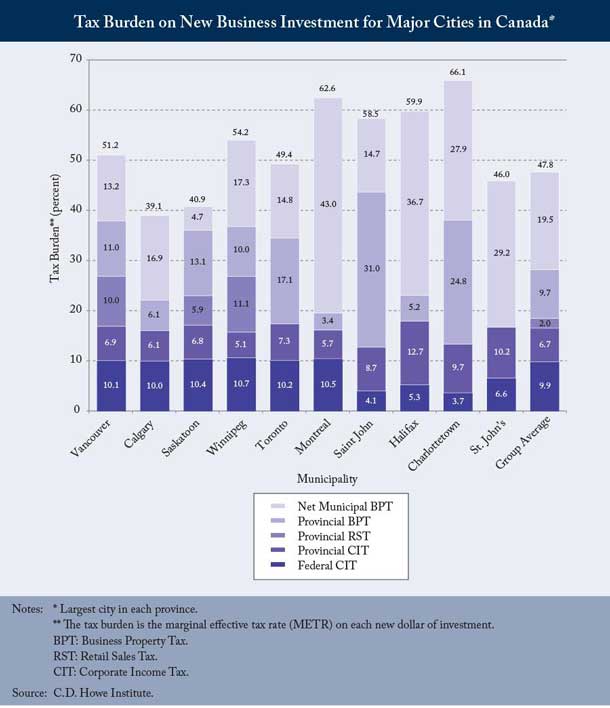

TORONTO – Business property taxes are a major part of the tax burden on new business investment that can tip the balance in the competition for capital among Canadian cities and provinces, according to a report released today by the C.D. Howe Institute. In “What Gets Measured Gets Managed: The Economic Burden of Business Property Taxes,” authors Adam Found, Benjamin Dachis, and Peter Tomlinson conduct groundbreaking research into the impact of business property taxes (BPTs) in localities across Canada and show where they are highest and lowest.

Calgary and Saskatoon Benefit

Calgary and Saskatoon have the lowest business property tax rates in Canada. Calgary is the fastest growing city in Canada and is also ranked as the ‘best place to live’ in Canada.

“Before a business makes a new investment in a locality, it must know the tax burden it faces; economists call this the marginal effective tax rate. In this report, we show for the first time just how much business property taxes drive up that rate in jurisdictions across Canada,” said Adam Found. “At present, business property taxes aren’t included in government estimates of the total tax burden on new investment, but they should be.”

Thunder Bay Situation on Business Property Taxes

Business Property Taxes in Thunder Bay have been falling for the past number of years.

Thunder Bay has, overall higher property taxes than many communities. In May, the Thunder Bay Chamber of Commerce express concern over what the Chamber saw as a move to increase business taxes.

“We understand that Council is looking to mitigate high residential and multi-residential reassessments and we believe these adjustments are fair within the current circumstances for 2013,” said Charla Robinson, Chamber President. “However, we are disappointed that the business community was not consulted prior to changing these tax ratios which will result in higher business taxes.”

Robinson adds, “It is a lot better know than it was, it is improving”.

However the Chamber of Commerce President explains that some of the challenges stem from a decision made by Council in the late 1990s to transfer some of the tax burden to industrial sectors of Thunder Bay’s economy. The ‘perfect storm’ that saw forestry hit really hard left the city will far fewer industrial taxpayers. “That adds to the complexity of the issue,” commented Robinson.

The other side of the issue in Thunder Bay is related to the real estate market, and the resulting higher property tax assessments on both residential and business properties.

Marginal Effective Tax Rates

By analyzing the impact of provincial BPTs, the authors find marginal effective tax rates (METRs) are substantially higher than previously thought, especially in New Brunswick, Prince Edward Island, Ontario, and Saskatchewan. By measuring BPTs in the largest city in each province, the authors find BPTs have the largest effect on METRs in Montreal, Halifax, Charlottetown, and St. John’s.

Large tax burdens due to a BPT – a form of capital tax – show that governments should include provincial and net municipal BPTs in their METR estimates. If governments did so, they would be more motivated to lower BPT rates, thus reducing the tax burden on new investment.

“Including BPTs in estimates of the marginal effective tax rate would give jurisdictions a clearer picture of their comparative attractiveness for new investment and motivate them to lower BPTs,” said Benjamin Dachis.

The C. D. Howe Institute is an independent not-for-profit research institute whose mission is to raise living standards by fostering economically sound public policies. It is Canada’s trusted source of essential policy intelligence, distinguished by research that is nonpartisan, evidence-based and subject to definitive expert review. It is considered by many to be Canada’s most influential think tank.

For the report go to: http://www.cdhowe.org/what-gets-measured-gets-managed-the-economic-burden-of-business-property-taxes/23117