THUNDER BAY – Business – Do you have people coming to your business using Status Cards? In Thunder Bay, millions of dollars are spend by people who possess Status Cards. The card allows the person making a purchase in your business to not pay the provincial sales tax.

Nishnawbe-Aski Nation (NAN) recently completed a report on the Economic impact of First Nations spending in Thunder Bay. “We were amazed when we began to add up how much money is contributed to the economy by First Nations, First Nation businesses and organizations,” said NAN Deputy Grand Chief Goyce Kakegamic.

The real figures when you include individual customers is massive. Millions and millions of dollars are spend in our community every year by First Nations residents and visitors. Treating customers with respect only makes sense.

Status Cards and Your Customers

Yet in many businesses, and in particular in retail businesses, far too often customers get treated badly for using their Status Card in many instances. For business owners, often it is likely not noted by managers, but many people experience clerks rolling their eyes, or making a customer spending money in the business feel uncomfortable. Likely in many cases, the opportunity for repeat business can be lost. That is costing your business sales, and costing your business its hard earned reputation.

Reportedly the Thunder Bay Chamber of Commerce are looking into an education program on this, it would be a welcome addition to the Chambers tools to help business.

For business owners, the reality is simple, if your clerks or staff are making a person spending money in your business uncomfortable, it is going to impact your business. Treating all customers with respect will help boost the reputation of your business, and in today’s ever connected world with Twitter, Facebook and other social media, the potential damage an uniformed clerk or staff member could be doing to your business should be a concern.

Data was collected on office expenditures, property taxes, payroll, meetings and conferences, travel expenses as well as education expenses for NAN First Nations students attending school in Thunder Bay. The findings are preliminary, but data pending from 13 more organizations and the retail sector is expected to boost the total financial contribution to as much as $100 million annually.

“The truth is we are major economic contributors to the economy,” said Kakegamic, who plans to continue gathering data on a quarterly basis. “First Nation organizations offer a variety of professional services and hold numerous meetings, conferences and cultural events that support the economies of urban centres.”

Treating customers, standing in a line-up cash or debit card in hand with respect is a part of the customer service that each business likely aspires to. Putting in an education program to train staff is a great way to boost your business.

The moment it takes to record the information will likely pay off in increased customer goodwill and in more repeat sales.

Here is what you need to know: Ontario Sales Tax

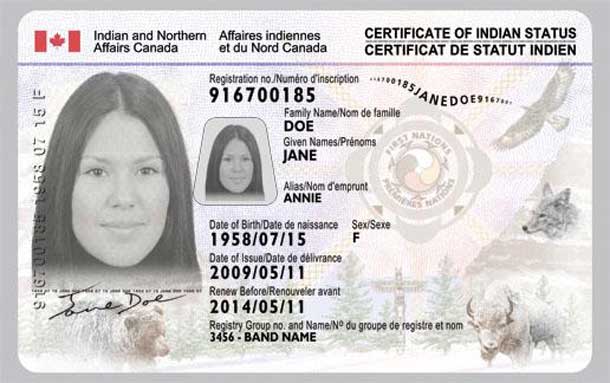

Effective September 1, 2010, Status Indians may claim an exemption from paying the eight per cent Ontario component of the Harmonized Sales Tax (HST) on qualifying property or services at the point of sale. Qualifying property and services are described in Guide 80 – Ontario First Nations Point-of-Sale Exemptions. To receive the exemption, the Status Indian must present their “Certificate of Indian Status” identity card at the time of making a purchase.

The Ontario Government states:

“The point-of-sale exemption for Status Indians, Indian bands and councils of an Indian band will apply only to qualifying off-reserve acquisitions or importations of property or services that are for the personal consumption of the Status Indian or exclusively for consumption or use by the band or the council of the band.

“The Status Indian point-of-sale exemption will not apply where any other relief is available, such as:

- when the purchaser is eligible for input tax credits for the HST payable (e.g., because the purchase is for use in the purchaser’s commercial activities);

- in cases where the supply is already relieved of the HST because it is zero-rated (e.g., basic groceries) or exempt (e.g., certain health care services); or

- when the property is a designated item that qualifies for an Ontario point-of-sale rebate for the Ontario component of the HST (e.g., children’s clothing, printed books).

“Effective September 1, 2010, vendors will provide a credit (exemption) at the time of sale of the eight per cent Ontario component of the HST for qualifying off-reserve property or services.

“Also effective September 1, 2010, the Canada Border Service Agency (CBSA) will credit the eight per cent Ontario component of the HST on qualifying goods imported by Ontario Status Indians, Indian bands and councils of Indian bands”.

For more information visit: www.fin.gov.on.ca

Read More: Mythbusting – Do Aboriginal People Pay Taxes?