THUNDER BAY – Mining activity in Northern Ontario is expected to fuel a more solid housing market than the rest of Ontario. However, Ontario housing activity is set to moderate in the next few months and isn’t expected to stabilize until the latter part of 2011 according to the 2011 Third Quarter CMHC Housing Market Outlook – Canada Edition.

THUNDER BAY – Mining activity in Northern Ontario is expected to fuel a more solid housing market than the rest of Ontario. However, Ontario housing activity is set to moderate in the next few months and isn’t expected to stabilize until the latter part of 2011 according to the 2011 Third Quarter CMHC Housing Market Outlook – Canada Edition.

Highlights of the Ontario forecast include:

- Ontario economy lags activity in rest of Canada during 2011/12 after leading in 2010;

- Current trends suggest existing home sales will slow before growing modestly into 2012;

- Owing to economic uncertainty, Ontario sales will range between 172,000 to 216,000 transactions this year and next year;

- After sharp increases early this year, Ontario home prices will ease in the next few months and grow closer to inflation by 2012 as markets move to a more balanced state;

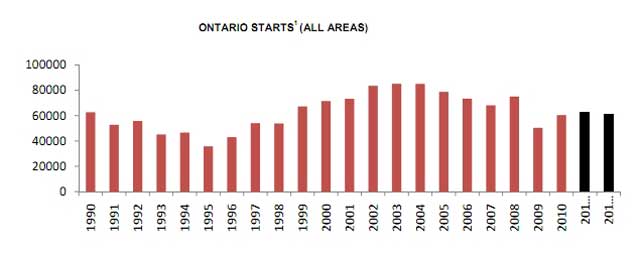

- Ontario home starts will moderate the rest of this year and into 2012 before growing later next year;

- Owing to economic uncertainty, starts will range between 53,000 to 68,000 units this year and next;

- Demand for apartment ownership and rental accommodation will remain strong.

“Consumer buying patterns, particularly in more expensive southern Ontario markets, will increasingly shift to less expensive housing over the next few years thanks to higher home prices. This bodes well for the apartment ownership and rental sector,” said Ted Tsiakopoulos, CMHC’s Ontario Regional Economist. “Northern Ontario housing markets are an exception as strong activity in the mining sector and relatively more affordable housing will support growing demand for low density housing,” added Tsiakopoulos.