THUNDER BAY – The recent deliberations leading up to City Council’s approval of the 2011 operating budget have focused mainly on expenditure items, tax rates and water rates. Indeed, the approval of a 1.27 per cent increase in the property tax rate coupled with a 14.3 percent increase in water rates at a time when gasoline, food and electricity prices are rising will inevitably cause some distress amongst the city’s citizens but the public’s response has generally been quite muted. Obviously, the rates are not high enough yet, which will only encourage our municipal governors further next year.

What was most disappointing about the budget deliberations was of course the absence of any meaningful long-term discussions of Thunder Bay’s fiscal future given the erosion of the tax base, the growing residential tax burden and the rather large debt load the city has taken on. This debt load is likely to get much larger given the cost overruns on the waterfront park development as well as the proposed Multiplex project, which will inevitably also require some new municipal debt (that will in turn be used to “leverage” some federal and provincial contributions). While such construction projects create jobs, the benefits in terms of employment and company profits are short term while the debt tends to last forever.

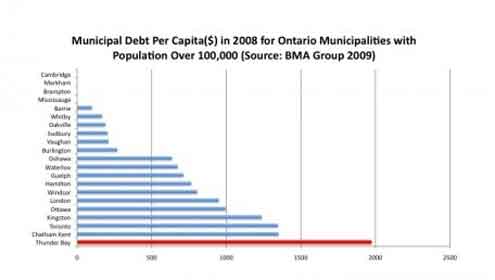

Figure 1 below presents a chart on municipal debt per capita from the 2009 BMA Consulting Group Municipal Study for municipalities in Ontario with a population greater than 100,000 and ranks them from lowest to highest.

The results show that Thunder Bay is finally ranked number one in something – the amount of municipal debt per capita, which in this report stood at $1,974 per capita. Debt per se is not a serious problem provided that there are reserves to counterbalance them and Thunder Bay’s municipal reserves are substantial – with the city ranking 8th highest among this same group of municipalities. However, at only $1,040 per capita at the time of this study, there is obviously a major fiscal gap here.

The results show that Thunder Bay is finally ranked number one in something – the amount of municipal debt per capita, which in this report stood at $1,974 per capita. Debt per se is not a serious problem provided that there are reserves to counterbalance them and Thunder Bay’s municipal reserves are substantial – with the city ranking 8th highest among this same group of municipalities. However, at only $1,040 per capita at the time of this study, there is obviously a major fiscal gap here.

Can we deal with the situation by raising more revenue? Well, revenues come mainly from property taxes, user fees and government grants. Government grants are unlikely to see major increases over the next few years given the provincial fiscal situation. As for taxes and users fees, well they have already been raised a lot and indeed much of the tax burden is now on the residential ratepayer given the erosion of the industrial base. Indeed, if one compares property taxes for an average bungalow in Thunder Bay to the other major Northern Ontario cities, Thunder Bay has the highest. The 2009 BMA Group Municipal study places those taxes at $2,991 for Thunder Bay, $2,939 for North Bay, $2,727 for Timmins, $2,434 for Sudbury and $2,301 for Sault Ste. Marie.

City councilors and administrators will inevitably come up with many ingenious explanations about these comparisons that will focus on how unique or special our circumstances are, and that we are comparing ‘apples’ with “oranges”. Indeed, if one added up the frequency this fruit analogy was used by the City of Thunder Bay, one might think that Northwestern Ontario and not the Niagara peninsula was the fruit belt. The point is its time to deal with the long-term finances of the City of Thunder Bay before there is an actual fiscal crisis. One cannot acquire an ever larger amount of debt without there being consequences down the road. Thinking otherwise is simply a fiscal fantasy.

Livio Di Matteo

Livio Di Matteo is an economist in Thunder Bay, Ontario specializing in public policy, health economics, public finance and economic history. Livio Di Matteo is a graduate of the Fort William Collegiate Institute (1898-2005) whose school motto “Agimus Meliora” has served as a personal inspiration. Livio Di Matteo holds a PhD from McMaster University, an MA from the University of Western Ontario and an Honours BA from Lakehead University. He is Professor of Economics at Lakehead University where he has served since 1990. His research has explored the sustainability of provincial government health spending, historical wealth and asset holding and economic performance and institutions in Northwestern Ontario and the central North American economic region. His historical wealth research using census-linked probate records is funded by grants from the Social Sciences and Humanities Research Council of Canada. He has constructed, assembled and analyzed nearly 12,000 estate files for Ontario over the period 1870 to 1930. Livio Di Matteo writes and comments on public policy and his articles have appeared in the National Post, Toronto Star, the Winnipeg Free Press and Thunder Bay Chronicle-Journal and NetNewsledger.com. Livio Di Matteo has had an entry in Canadian Who’s Who since 1995.

Livio Di Matteo is an economist in Thunder Bay, Ontario specializing in public policy, health economics, public finance and economic history. Livio Di Matteo is a graduate of the Fort William Collegiate Institute (1898-2005) whose school motto “Agimus Meliora” has served as a personal inspiration. Livio Di Matteo holds a PhD from McMaster University, an MA from the University of Western Ontario and an Honours BA from Lakehead University. He is Professor of Economics at Lakehead University where he has served since 1990. His research has explored the sustainability of provincial government health spending, historical wealth and asset holding and economic performance and institutions in Northwestern Ontario and the central North American economic region. His historical wealth research using census-linked probate records is funded by grants from the Social Sciences and Humanities Research Council of Canada. He has constructed, assembled and analyzed nearly 12,000 estate files for Ontario over the period 1870 to 1930. Livio Di Matteo writes and comments on public policy and his articles have appeared in the National Post, Toronto Star, the Winnipeg Free Press and Thunder Bay Chronicle-Journal and NetNewsledger.com. Livio Di Matteo has had an entry in Canadian Who’s Who since 1995.

Livio Di Matteo

This article was originally posted on Livio Di Matteo’s NORTHERN ECONOMIST Blog at http://ldimatte.shawwebspace.ca.